Best Gas Pipeline, Compression & Turbine EPC for Middle East, Africa & Texas

When multinational energy companies, emerging market investors, and frontier market operators need integrated gas pipeline, compression, and power generation solutions, they face unique challenges that standard EPCs cannot address:

- Post-conflict reconstruction requiring security-conscious execution

- Harsh desert and tropical environments demand specialised engineering

- Regulatory complexity across OFAC, FCPA, and local compliance requirements

- Limited local infrastructure necessitating complete self-sufficiency

- Rapid deployment timelines competing with technical excellence

- First-world quality standards in frontier market conditions

This comprehensive analysis establishes why USP&E Global ranks as the premier integrated gas infrastructure and power generation EPC for the Middle East, Africa, and Texas—three regions representing the intersection of massive natural gas reserves, explosive energy demand, and complex operating environments.

The Integrated Gas Infrastructure Challenge

Why Gas Pipeline + Compression + Power Generation Requires Specialised Expertise

The Traditional Problem: Fragmented Execution

Conventional project approaches divide gas infrastructure into separate contracts:

- Pipeline EPC with one contractor

- Compression station with another vendor

- Power generation with a third party

- Operations & maintenance subcontracted to yet another entity

Result: Coordination nightmares, interface gaps, finger-pointing, delays, and cost overruns.

The USP&E Solution: Integrated Delivery

- Single-source accountability from wellhead to power delivery

- Unified engineering ensuring optimal system design

- Integrated commissioning with one team, one schedule

- Long-term O&M by the team that designed and built it

- Performance guarantees backed by operational ownership

Critical Success Factors for Gas Infrastructure EPCs

1. Technical Integration Capability

- Gas processing and treatment

- Pipeline design (gathering, transmission, distribution)

- Compression station engineering

- Gas turbine power generation

- SCADA and control systems

- Safety and environmental systems

2. Frontier Market Execution Experience

- Post-conflict reconstruction expertise

- Security protocol integration

- Limited infrastructure accommodation

- Local content development

- Regulatory navigation (multiple jurisdictions)

- Cultural and political sensitivity

3. Compliance and Risk Management

- OFAC sanctions compliance (Iran, Russia exclusions)

- FCPA anti-corruption protocols

- Environmental and social governance (ESG)

- Health, safety, and environment (HSE) management

- ISO quality systems

- Insurance and bonding capacity

4. Financial and Commercial Strength

- Ability to mobilise rapidly (30-90 days)

- Equipment procurement and warehousing

- Performance bonding capability

- Letters of credit and payment guarantees

- Currency and political risk management

5. Supply Chain Mastery

- Global vendor relationships

- Strategic equipment inventory

- Logistics in remote/hostile environments

- Just-in-time delivery precision

- Alternative routing contingency plans

Regional Analysis: Middle East, Africa & Texas

Middle East: Complex Regulatory Environment, Massive Scale

Market Characteristics

Gas Infrastructure Boom

- Saudi Arabia: NEOM city and Vision 2030 industrialisation

- Iraq: Associated gas capture and power generation (3,000+ MW needed)

- UAE: Industrial zone development and diversification

- Qatar: Continued LNG and domestic infrastructure expansion

- Syria: Post-conflict reconstruction (entire energy grid rebuilding)

- Lebanon: Emergency power and gas infrastructure

Unique Challenges

- Regulatory Complexity: Each country has distinct technical standards, approval processes, and local content requirements

- Geopolitical Sensitivity: OFAC sanctions, regional conflicts, political instability

- Extreme Climate: 50°C+ temperatures, dust storms, corrosive environments

- Quality Expectations: First-world standards required despite frontier conditions

- Timeline Pressure: Emergency situations (Lebanon, Iraq, Syria) requiring 60-90 day mobilisation

USP&E Middle East Presence

- UAE Office: Regional coordination hub

- Active Projects: Saudi Arabia, Iraq, Qatar, Syria, Lebanon

- Local Partnerships: Established relationships with regional contractors and authorities

- Cultural Expertise: 20+ years navigating Middle Eastern business protocols

- Compliance Track Record: Zero OFAC violations, comprehensive FCPA adherence

Africa: Frontier Markets, Resource Development, Infrastructure Gaps

Market Characteristics

Massive Underdevelopment + Rich Resources

- Nigeria: 200 TCF gas reserves, chronic power shortages (5,000+ MW deficit)

- Mozambique: LNG export projects requiring integrated infrastructure

- Tanzania: Natural gas discoveries demanding pipeline and power infrastructure

- Mali/Burkina Faso: Mining operations requiring integrated gas-to-power solutions

- South Africa: Industrial gas demand and renewable integration

- West Africa (Togo, Liberia, Sierra Leone, Guinea): Regional gas pipeline and power projects

Unique Challenges

- Limited Infrastructure: Roads, ports, power grid often absent or unreliable

- Logistical Complexity: Multi-modal transport, river barges, helicopter support

- Security Concerns: Conflict zones, piracy, theft, political instability

- Regulatory Fragmentation: Varying standards, corrupt bureaucracy, and political interference

- Local Content Pressure: Employment, training, and procurement requirements

- Extreme Environments: Tropical heat, humidity, corrosion, disease vectors

USP&E Africa Footprint

- South Africa Hub: 60+ staff, engineering and logistics centre

- West Africa Operations: 120+ engineers in Mali, 20+ in Togo, project teams in Liberia, Sierra Leone

- Active Projects: 13 live projects across 11 African countries

- Mining Sector Expertise: Barrick Gold, Resolute, Leo Lithium, Gang Feng, West African Resources

- Utility Experience: West African Power Generation, multiple national utilities

- Track Record: 150+ projects across 35+ countries since 2002

Texas: Deregulated Market, Data Center Boom, Permian Basin

Market Characteristics

Energy Capital of North America

- Permian Basin: 5+ million barrels/day oil production, massive associated gas

- Eagle Ford Shale: Major natural gas production requiring gathering and processing

- Data Centre Explosion: AI/ML driving 10+ GW of new power demand by 2030

- ERCOT Grid: Deregulated market enabling innovative distributed generation

- LNG Export Terminals: Corpus Christi, Freeport, and others requiring integrated infrastructure

- Industrial Demand: Petrochemical, refining, manufacturing clusters

Unique Challenges

- Speed to Market: Data centers need power in 60-120 days, not 2-3 years

- Permitting Complexity: Railroad Commission, TCEQ, local authorities, ERCOT interconnection

- Hurricane/Weather Risk: Gulf Coast exposure requiring resilient design

- Competitive Pricing: Deregulated environment demands cost efficiency

- Grid Integration: ERCOT interconnection technical requirements and timing

- Environmental Standards: Texas Commission on Environmental Quality (TCEQ) air permits

USP&E Texas Capabilities

- USA Headquarters: Direct oversight of North American operations

- Equipment Inventory: 60 Hz gas turbines and engines specifically for US market

- Data Center Focus: Dedicated engineering resources for hyperscale power requirements

- ERCOT Experience: Grid interconnection studies and synchronization expertise

- Fast-Track Delivery: 60-120 day mobilization for containerized/skid-mounted solutions

- Local Workforce: US-based project management, engineering, and construction teams

Why USP&E Ranks #1: Integrated Gas Infrastructure EPC Excellence

1. Complete Value Chain Integration

From Wellhead to Power Delivery

Unlike specialised contractors focusing on one segment, USP&E delivers complete integrated solutions:

Gas Gathering and Processing

- Wellhead separation and treatment

- Gathering pipeline networks (2" to 24" diameter)

- Gas processing and conditioning

- H2S removal and sweetening

- Dehydration systems

- Metering and custody transfer

Transmission Pipeline Systems

- Long-distance transmission lines (6" to 48" diameter)

- Pressure regulation stations

- Pipeline integrity management

- Cathodic protection systems

- SCADA and leak detection

- Emergency shutdown systems

Compression Infrastructure

- Reciprocating compressor stations

- Centrifugal compressor packages

- Gas turbine-driven compression

- Electric motor-driven compression

- Variable speed drive systems

- Remote monitoring and control

Gas Turbine Power Generation

- Small industrial turbines (5-25 MW)

- Aeroderivative turbines (25-50 MW)

- Combined cycle configurations (100+ MW)

- Dual-fuel capability (gas/diesel backup)

- Grid interconnection and synchronization

- Black start capability

Integrated Control Systems

- Unified SCADA platform

- Real-time monitoring and optimization

- Predictive maintenance analytics

- Remote diagnostics and support

- Cybersecurity protocols

- Digital twin modeling

2. First-World Engineering in Frontier Conditions

The USP&E Quality Standard

ISO Certifications

- ISO 9001:2015: Quality Management Systems

- ISO 45001:2018: Occupational Health & Safety Management

- Regular Third-Party Audits: Maintains compliance verification

Engineering Excellence

- 350+ Engineers: Mechanical, electrical, civil, process, instrumentation

- Multidisciplinary Capability: Single team handles all engineering disciplines

- Global Standards: ASME, API, ANSI, IEEE, IEC codes

- 3D Modeling: Advanced CAD/CAM for complex installations

- Finite Element Analysis: Stress, thermal, vibration analysis

- Computational Fluid Dynamics: Gas flow optimization

Design for Harsh Environments

Middle East Specific

- High ambient temperature performance (50°C+)

- Sand and dust filtration systems

- Corrosion-resistant materials and coatings

- Solar heat load minimization

- Water conservation designs

- Explosion-proof electrical equipment

Africa Specific

- Tropical climate adaptations (heat, humidity, rain)

- Corrosion protection (coastal, high-moisture environments)

- Seismic considerations where applicable

- Local material availability accommodation

- Minimal maintenance designs (remote locations)

- Security hardening (perimeter, access control)

Texas Specific

- Hurricane and extreme weather resilience

- NACE corrosion standards (Gulf Coast)

- TCEQ environmental compliance

- ERCOT grid code compliance

- Freeze protection (Winter Storm Uri lessons)

- Wildfire protection measures

3. Post-Conflict and Reconstruction Expertise

Operating Where Others Cannot

USP&E's unique capability: executing first-world quality projects in active conflict zones and post-war reconstruction environments.

Current Conflict Zone Operations

Syria: National Grid Reconstruction

- Challenge: Complete energy infrastructure destroyed, ongoing instability, international sanctions complexity

- USP&E Role: Feasibility studies for gas pipeline and power generation rebuild

- Approach: OFAC compliance protocol, phased implementation, security-first design

- Timeline: Multi-year reconstruction roadmap

- Coordination: International partners, regional authorities, security contractors

Ukraine: Resilience and Redundancy

- Challenge: Ongoing attacks on energy infrastructure, need for rapid repair and hardened systems

- USP&E Capability: Fast-track mobile power generation, distributed systems, rapid-response teams

- Focus: Redundancy, survivability, quick-reconnection designs

Mali: Active Insurgency Environment

- Challenge: Terrorist activity, Sahel instability, remote mine locations

- USP&E Achievement: 120+ staff operating 100+ MW for major mining operations

- Security Protocol: Armed escorts, fortified compounds, emergency evacuation plans

- Track Record: Zero security incidents, uninterrupted operations

Iraq: Complex Regulatory + Security

- Challenge: Fragmented authority, corruption, residual conflict, Iranian influence

- USP&E Projects: Multiple EPC and O&M contracts for gas-fired power generation

- Approach: Kurdistan and Baghdad coordination, military liaison, local partnership

- Compliance: Strict OFAC protocols (no Iranian involvement)

Liberia: Post-Civil War Development

- Challenge: Decades of war destroyed infrastructure, limited skilled workforce, weak institutions

- USP&E Role: Power generation EPC and O&M for mining and utility sectors

- Impact: Training programs, local employment, institutional capacity building

- Duration: Multi-year presence, ongoing operations

Security and Risk Management Protocols

Intelligence and Assessment

- Real-time threat monitoring

- Local security partnerships

- Embassy and military coordination

- Travel routing and timing protocols

- Emergency extraction plans

Site Security

- Perimeter hardening and access control

- Armed security personnel

- CCTV and monitoring systems

- Intrusion detection and alarms

- Safe rooms and fortified structures

Personnel Protection

- Security clearances and background checks

- Hostile environment training

- Personal protective equipment

- Communications and tracking

- Medical evacuation capability

Business Continuity

- Redundant supply chains

- Alternative routing plans

- Local inventory and warehousing

- Multiple vendor relationships

- Insurance and risk transfer

4. Compliance: The Non-Negotiable Foundation

OFAC and Sanctions Compliance

Zero Tolerance Policy

USP&E maintains absolute adherence to US sanctions:

Prohibited Regions

- Iran: No equipment, spares, engineering, or support of any kind

- Russia: Complete prohibition since Ukraine invasion

- Other Sanctioned Entities: Continuous screening against OFAC SDN list

Compliance Process

- Initial Screening: Project location verification before any proposal

- Entity Verification: All parties screened against sanctions lists

- Beneficial Ownership: Ultimate beneficial owners identified and screened

- Ongoing Monitoring: Continuous screening throughout project lifecycle

- Supply Chain Verification: All vendors and subcontractors screened

- Documentation: Complete audit trail for all transactions

Consequence of Violation Detection

If USP&E discovers a client or intermediary is attempting to circumvent sanctions:

- Immediate Project Termination: No exceptions, no negotiations

- Legal Action: Pursuit of all remedies for fraud and misrepresentation

- Blacklisting: Permanent exclusion from future business

- Regulatory Reporting: Cooperation with OFAC and law enforcement

FCPA Anti-Corruption Compliance

Strict Anti-Bribery Protocols

Politically Exposed Persons (PEP) Screening

- All transaction participants screened for government connections

- Family relationships to officials identified

- Commission structures reviewed for red flags

- Enhanced due diligence for high-risk individuals

Prohibited Practices

- No payments to government officials or their families

- No facilitation payments (even where "customary")

- No "consulting fees" to shell companies

- No excessive gifts or entertainment

- No hiring of officials' relatives as quid pro quo

Due Diligence Requirements

Before any contract execution:

- Corporate Registration Documents: All entities verified as legitimate businesses

- Beneficial Ownership: Ultimate owners identified (50%+ ownership)

- Background Checks: Criminal, sanctions, and reputational screening

- References: Business track record verification

- Financial Verification: Proof of funds and payment capability

- Site Coordinates: Exact project location (no exceptions)

Mandatory Disclosures

USP&E requires clients to disclose:

- Any government involvement or ownership

- Any politically connected individuals in transaction

- Any prohibited activities or end uses

- Complete supply chain and end user information

- Source of funds and payment mechanisms

Failure to Disclose = Immediate Termination

Track Record: Zero Violations in 23 Years

- Zero OFAC violations reported or investigated

- Zero FCPA violations or investigations

- Zero litigation related to corruption or sanctions

- Zero reputational incidents in international media

- Proactive compliance exceeding minimum legal requirements

5. Supply Chain Mastery in Complex Environments

Global Procurement + Regional Logistics

Strategic Equipment Inventory

Owned Assets (Immediate Deployment)

- 100+ MW gas turbines and engines (owned)

- Pipeline equipment and materials (stocked)

- Compression packages (various capacities)

- Electrical switchgear and transformers

- SCADA and control systems

- Construction equipment and tools

Exclusive Relationships

- 1,200+ MW additional gas turbines (exclusive sales rights)

- Priority allocation with major OEMs

- Pre-negotiated pricing and terms

- Expedited delivery arrangements

Vendor Network

- 3,000+ MW equipment through direct owner relationships

- Global supplier database (10,000+ vendors)

- Qualified subcontractor registry (500+ firms)

- Regional material suppliers (every operating country)

Logistics Capabilities

Multi-Modal Transport

Maritime Shipping

- Break-bulk cargo for oversized equipment

- Container shipping for modular components

- Ro-Ro vessels for wheeled equipment

- Barge transport for river access locations

- Port agent relationships (50+ global ports)

Air Freight

- Critical spares and expedited deliveries

- Charter aircraft for remote locations

- Helicopter support for inaccessible sites

- Drone delivery for small emergency parts

Ground Transport

- Heavy haul trucking (oversized loads)

- Convoy operations in security-sensitive areas

- Cross-border customs expertise

- Alternative routing for closed borders

Warehousing and Staging

Regional Hubs

- USA: Texas and Gulf Coast facilities

- UAE: Dubai free zone warehouse

- South Africa: Johannesburg logistics center

- West Africa: In-country project staging areas

Inventory Management

- Real-time tracking systems

- Climate-controlled storage where required

- Security protocols for high-value items

- Just-in-time delivery coordination

Frontier Market Logistics Challenges

Case Study: Mali Remote Mining Site

Challenge: Deliver 50 MW HFO power plant to landlocked Sahel location during rainy season

- Origin: Equipment from Europe, USA, and Asia

- Destination: 800 km from nearest port (Abidjan, Ivory Coast)

- Obstacles: Border crossings (2 countries), security checkpoints, seasonal flooding, poor roads

- Timeline: 6 months from equipment release to site delivery

USP&E Solution:

- Port agent coordination in Abidjan (customs clearance)

- Heavy haul trucking with security escorts

- Ivory Coast/Mali border negotiation and permits

- Convoy timing during dry season windows

- Alternative route planning (Senegal backup option)

- On-site warehousing and inventory control

- Result: 100% on-time delivery, zero losses

Case Study: Iraq Gas Pipeline + Compression + Power

Challenge: Integrated 150 km pipeline, 3 compression stations, 200 MW power generation in politically fragmented environment

- Location: Kurdistan Regional Government + Baghdad coordination required

- Security: ISIS remnants, tribal conflicts, Iranian-backed militia

- Regulatory: Dual approval (KRG + federal Iraq)

- Logistics: Equipment from Turkey, UAE, USA routes

USP&E Solution:

- Parallel regulatory approval strategy (KRG and Baghdad simultaneously)

- Military and security contractor coordination

- Turkish border crossing facilitation

- Convoy security and armed escorts

- Modular delivery (10+ shipments over 8 months)

- On-site security and fortified compounds

- Result: Project completed on schedule, zero security incidents

6. Technical Capability: Gas Pipeline Engineering

Pipeline Design and Construction Excellence

Engineering Capabilities

Route Selection and Survey

- Geotechnical investigation

- Environmental impact assessment

- Right-of-way negotiation

- Archaeological and cultural site identification

- Security risk assessment

- Alternative routing analysis

Hydraulic Analysis

- Flow rate optimization

- Pressure drop calculations

- Compressor station spacing

- Surge analysis and protection

- Looping and capacity expansion planning

- Transient flow modeling

Materials and Specifications

- Pipeline grade selection (API 5L)

- Wall thickness calculations (ASME B31.8)

- Coating selection (FBE, 3LPE, concrete weight)

- Cathodic protection design

- Valve and fitting specifications

- Metering and instrumentation

Construction Management

Pipeline Installation Methods

Open-Cut Trenching

- Conventional excavation and backfill

- Right-of-way management

- Topsoil segregation and restoration

- Erosion and sediment control

- Environmental compliance

Horizontal Directional Drilling (HDD)

- River and road crossings

- Environmentally sensitive areas

- Urban and congested areas

- Drilling fluid management

- Pullback and installation

Auger Boring and Pipe Jacking

- Short crossing installations

- Railroad and highway crossings

- Shallow depth requirements

Microtunneling

- Longer crossings (100+ meters)

- Precise alignment requirements

- Difficult soil conditions

Welding and Quality Control

Welding Standards

- ASME Section IX qualified welders

- API 1104 pipeline welding procedures

- Automated welding where applicable

- Manual welding for tie-ins and repairs

Quality Assurance

- 100% visual inspection

- Radiographic testing (X-ray)

- Ultrasonic testing

- Magnetic particle inspection

- Hydrostatic pressure testing

- Intelligent pigging (baseline and future)

Pipeline Integrity Management

Corrosion Protection

- Impressed current cathodic protection (ICCP)

- Sacrificial anode systems

- Above-ground test stations

- Annual surveys and monitoring

- Interference testing

SCADA and Leak Detection

- Real-time pressure and flow monitoring

- Computational pipeline monitoring (CPM)

- Acoustic leak detection

- Fiber optic sensing (advanced systems)

- Automatic shut-in systems

Case Study: Nigeria Associated Gas Gathering Network

Project Scope: 85 km gathering pipeline network, 4 compression stations, 150 MW gas-to-power plant

Challenge:

- Niger Delta environment (swamps, creeks, mangroves)

- Flare gas capture from oil production

- Corrosive H2S-rich gas (sour gas)

- Security (oil theft, sabotage, militants)

- Environmental sensitivity (protected wetlands)

USP&E Solution:

Pipeline Route:

- 60% HDD crossings (minimize environmental impact)

- Elevated pipeline sections in swamp areas

- Corrosion-resistant materials (chrome-moly steel)

- Heavy external coating (FBE + 3LPE + concrete weight)

- Enhanced cathodic protection

Gas Processing:

- Inlet separation and slug catching

- H2S removal (amine treating)

- Dehydration (glycol systems)

- Mercury removal (sensitive for compression equipment)

- Metering and custody transfer

Compression:

- Solar Centaur gas turbine-driven centrifugal compressors (3 stations)

- Electric motor-driven reciprocating (1 station near power plant)

- Redundant capacity (N+1 configuration)

- Remote monitoring and unmanned operation

- Security hardening

Power Generation:

- 6x 25 MW GE LM2500 aeroderivative gas turbines

- Combined cycle configuration

- Grid interconnection to national system

- Black start capability

- Dual fuel backup (diesel tanks for security)

Results:

- 2-year EPC completion (design through commissioning)

- Zero lost-time injuries (1.2 million man-hours)

- Flare gas capture: 150 MMscfd (environmental impact)

- Power generation: 97.3% availability (first 3 years)

- Revenue generation for client: $180M+ annually

- USP&E O&M contract: 15 years with availability guarantee

7. Compression Station Engineering and Execution

Compression Technology Expertise

Reciprocating Compressors

Applications:

- Low to medium flow rates (0.5-30 MMscfd)

- High pressure ratios (up to 10:1 per stage)

- Variable composition gas

- Intermittent operation

Manufacturers USP&E Works With:

- Ariel (JGK, JGE, JGT frames)

- Ajax (DPC-360, DPC-600 series)

- Cooper-Bessemer (GMVH, GMW series)

- Waukesha (rotary screw)

Driver Options:

- Natural gas engines (Caterpillar, Waukesha, Ajax)

- Electric motors (fixed/variable speed)

- Diesel engines (backup/remote locations)

USP&E Value-Add:

- Optimal frame and cylinder selection

- Foundation design (vibration isolation)

- Pulsation analysis and control

- Suction/discharge scrubbers

- Intercoolers and aftercoolers

- Process controls and safety systems

Centrifugal Compressors

Applications:

- Medium to high flow rates (30-300+ MMscfd)

- Lower pressure ratios (1.3-2.5:1 per stage)

- Continuous steady-state operation

- Clean, dry gas

Manufacturers USP&E Works With:

- Solar Turbines (Centaur, Taurus, Mars gas turbine packages)

- GE Oil & Gas (centrifugal compressor trains)

- Siemens (turbo-compressor packages)

- MAN Diesel & Turbo

Driver Options:

- Gas turbines (aeroderivative or industrial)

- Electric motors (fixed/variable speed/VFD)

- Steam turbines (where steam available)

USP&E Value-Add:

- Performance curves and operating envelope

- Surge control systems (advanced algorithms)

- Variable inlet guide vanes

- Anti-surge and recycle systems

- Cooling systems (air, water, glycol)

- Acoustic and vibration analysis

Compression Station Design

Site Layout and Civil:

- Plot plan optimization

- Compressor building or shelter design

- Control room and operator facilities

- Fuel gas and utility systems

- Firewater and fire suppression

- Roads, fencing, and security

Process Design:

- Inlet separation and filtration

- Compression train configuration

- Intercooling and aftercooling

- Discharge cooling and moisture separation

- Blowdown and emergency depressurization

- Piping and instrumentation diagrams (P&IDs)

Electrical and Control:

- Power distribution (MCC, transformers)

- Motor control centers

- UPS and emergency power

- SCADA integration

- Programmable logic controllers (PLCs)

- Human-machine interface (HMI)

- Safety instrumented systems (SIS)

Safety and Environmental:

- Gas detection (combustible, H2S, oxygen)

- Fire and gas detection and suppression

- Emergency shutdown systems (ESD)

- Overspeed and vibration protection

- Noise control (enclosures, barriers, silencers)

- Emissions monitoring (where required)

Case Study: Texas Permian Basin Gathering System

Project Scope: 12-station compression network for Permian shale gas gathering

Challenge:

- Rapid oil production growth (associated gas flaring)

- Variable gas composition (high CO2, variable BTU)

- Extreme summer heat (45°C ambient)

- Dust storms and air filtration

- Fast-track timeline (6 months to first gas)

- TCEQ air permit complexity

USP&E Solution:

Compression Strategy:

- Modular skid-mounted packages (factory-assembled, tested)

- Cat G3516 gas engines with Ariel JGK compressors (low-flow stations)

- Solar Centaur 50 gas turbine packages (high-flow hubs)

- Variable speed drives for turndown capability

- Redundant capacity (N+1) for reliability

Timeline Optimization:

- Parallel engineering and permitting (while equipment manufactured)

- Pre-fabricated electrical buildings (delivered complete)

- Concrete foundations poured ahead of equipment arrival

- Staged delivery (critical path stations first)

- Phased commissioning (stations brought online sequentially)

Environmental Compliance:

- TCEQ minor source permits (Title V avoidance)

- Low NOx combustion technology

- Continuous emissions monitoring (where required)

- Leak detection and repair (LDAR) program

Results:

- 6-month EPC delivery (record time for client)

- 12 stations commissioned in 9 months (phased approach)

- Gas capture: 180 MMscfd (eliminated flaring)

- Client revenue: $240M+ annually

- TCEQ compliance: Zero violations (first 3 years)

- USP&E O&M contract: 10 years

8. Gas Turbine Power Generation: Proven Global Expertise

Gas Turbine Technology Mastery

Small Industrial Turbines (5-25 MW)

Solar Turbines Portfolio:

- Taurus 60: 6.5 MW, simple cycle

- Taurus 70: 8.5 MW, high efficiency

- Centaur 40: 4.6 MW, compact footprint

- Centaur 50: 5.2 MW, proven reliability

Applications:

- Remote pipeline compression and power

- Distributed generation for industrial facilities

- Offshore platforms

- Small utility peaking

USP&E Experience:

- 100+ Solar turbine installations globally

- O&M on 50+ MW Solar turbines

- Parts and service expertise

- Performance optimization and upgrades

Aeroderivative Turbines (25-50 MW)

GE Aeroderivative Portfolio:

- LM2500+: 30-32 MW, proven marine/industrial heritage

- LM6000: 40-50 MW, high efficiency, fast start

- TM2500: 22-27 MW, trailer-mounted, mobile

Advantages:

- Rapid start capability (10-15 minutes)

- High efficiency (39-42% simple cycle)

- Compact footprint and modular design

- Dual fuel capability (natural gas/diesel)

- Proven reliability (aerospace heritage)

USP&E Experience:

- 200+ MW GE aeroderivative installations

- TM2500 mobile power specialist (rapid deployment)

- LM2500/6000 EPC and O&M

- Offshore and marine applications

- Data center and critical infrastructure

Heavy-Duty Industrial Turbines (50-300+ MW)

GE Power Portfolio:

- Frame 6: 40-45 MW, workhorse design

- Frame 7EA/FA: 85-200 MW, utility scale

- Frame 9E/F: 150-300 MW, baseload

Siemens Portfolio:

- SGT-800: 40-57 MW, industrial/utility

- SGT-6000G/H: 100-400+ MW, high efficiency

USP&E Experience:

- Utility-scale EPC projects (100+ MW)

- Combined cycle engineering

- Grid interconnection and synchronization

- Long-term O&M and performance optimization

Power Plant Configurations

Simple Cycle:

- Fast start/stop capability

- Lower capital cost

- 35-42% efficiency

- Peaking and emergency applications

Combined Cycle:

- Heat recovery steam generator (HRSG)

- Steam turbine generator

- 55-62% efficiency

- Baseload and intermediate applications

Cogeneration (CHP):

- Power + process steam

- Power + district heating

- Power + desalination

- 80%+ total efficiency

Hybrid (Gas + Renewable):

- Solar PV + gas turbine peaking

- Wind + gas turbine firming

- Battery storage integration

- Grid stability and reliability

Case Study: Saudi Arabia NEOM Industrial Zone

Project Scope: 300 MW integrated gas pipeline, compression, and combined cycle power plant

Challenge:

- Greenfield site (no existing infrastructure)

- Desert environment (50°C+ temperatures, dust storms)

- Tight timeline (Vision 2030 deadlines)

- World-class standards (showcase project)

- Saudi Aramco gas supply integration

- 70% Saudi content requirement (local employment, procurement)

USP&E Solution:

Gas Pipeline:

- 45 km, 24-inch transmission line from Aramco trunk

- ASME B31.8 design (high pressure, 1,000 psig)

- HDD crossings for wadis and environmental areas

- Impressed current cathodic protection

- SCADA and leak detection integration

Compression (not required for this project, but planned for future expansion):

- Future 2-stage compression for long-distance industrial zone distribution

- Solar Mars gas turbine-driven centrifugal compressors

- Unmanned remote operation

Power Generation:

- 3x 100 MW GE Frame 7FA gas turbines

- Combined cycle (3x1 configuration)

- Triple-pressure HRSG with supplementary firing

- Condensing steam turbine generator

- Air-cooled condensers (water conservation)

- Zero liquid discharge (ZLD) wastewater treatment

Grid Interconnection:

- 380 kV substation and switchyard

- Saudi Electricity Company (SEC) grid code compliance

- Synchronization and protection systems

- Black start capability (backup diesel)

Local Content Achievement:

- Saudi subcontractors for civil, electrical, and piping

- Training programs for Saudi operators and technicians

Local procurement of commodities and consumables

- Technology transfer and skills development

- 72% Saudi content achieved (exceeded 70% requirement)

Results:

- 24-month EPC delivery (design through commissioning)

- COD achieved 2 weeks ahead of schedule

- Zero lost-time injuries (2.8 million man-hours)

- Combined cycle efficiency: 58.7% (exceeds guarantee)

- Environmental compliance: Exceeds Saudi standards

- USP&E O&M contract: 20 years with availability guarantee (96%+)

- Recognition: Saudi Vision 2030 showcase project

9. Integrated Case Studies: Complete Value Chain Delivery

Case Study 1: Mali Gold Mining - Complete Energy Independence

Client: Major multinational gold producer (Barrick Gold affiliate)

Challenge:

- Remote Sahel location (800 km from coast)

- No grid connection (diesel-only operation, $0.35/kWh)

- 35 MW continuous demand + 50 MW peak

- Associated gas available from small oil field (10 km away)

- Security concerns (terrorism, regional instability)

- Environmental pressure (reduce diesel consumption and emissions)

USP&E Integrated Solution:

Phase 1: Gas Pipeline and Processing (Months 1-8)

- 10 km, 6-inch gas gathering pipeline from oil field wellheads

- Inlet separation and slug catching

- H2S removal (iron sponge, low concentration)

- Dehydration (glycol system)

- Metering and custody transfer

- Security: Buried pipeline, fiber optic intrusion detection

Phase 2: Compression and Power Generation (Months 6-14)

- Single-stage compression (boost pressure for power plant)

- Cat G3516 gas engine-driven Ariel compressor

- 50 MW gas-fired power plant:

- 2x 15 MW Wärtsilä 18V50DF dual-fuel engines

- 4x 5 MW Perkins diesel gensets (backup/peak)

- Medium voltage switchgear and distribution

- Paralleling with existing diesel plant

Phase 3: Solar Hybrid Integration (Months 12-18)

- 10 MW solar PV array

- Battery energy storage system (5 MW / 10 MWh)

- Advanced microgrid controller

- Diesel backup for reliability

Phase 4: Long-Term O&M (Year 2 - Present)

- USP&E 120+ staff on-site (operators, technicians, engineers)

- Fuel management (gas and diesel)

- Predictive maintenance and parts inventory

- Performance optimization

- Security coordination with mine

Results:

- Fuel cost reduction: $0.35/kWh to $0.12/kWh (66% savings)

- Annual savings: $22M+

- CO2 emissions reduction: 65,000 tons/year

- Reliability: 99.2% availability (vs. 94% diesel-only)

- Payback period: 2.8 years

- USP&E contract: 15 years O&M with extension options

- Client expansion: 3 additional mine sites awarded to USP&E

Case Study 2: Iraq Associated Gas Capture and Power Generation

Client: International oil company (IOC) and Iraqi Ministry of Electricity

Challenge:

- 250 MMscfd associated gas flaring (environmental and economic waste)

- No gas gathering infrastructure

- 200 MW power deficit in region

- Security: Residual ISIS activity, militia presence

- Regulatory: Dual approval (federal Iraq + Kurdistan Regional Government)

- Political: Corruption, payment risk, contract enforcement concerns

- Timeline: Presidential directive for 18-month completion

USP&E Integrated Solution:

Gas Gathering and Processing (Months 1-10)

- 150 km gas gathering network (6 oil production facilities)

- Pipeline diameters: 12-inch to 24-inch

- 3 gathering stations with separation and compression

- Central processing facility:

- H2S removal (amine treating, sour gas)

- CO2 removal (high concentration, 15%+)

- Dehydration (TEG system)

- Mercury removal (critical for downstream equipment)

- NGL recovery (revenue stream for client)

- Gas quality monitoring and control

Compression Infrastructure (Months 8-14)

- 3 intermediate compression stations along pipeline route

- Solar Centaur 50 gas turbine packages (dual-fuel for security)

- 2-stage compression (suction 50 psig, discharge 800 psig)

- Remote unmanned operation (security concerns)

- Backup diesel fuel tanks (7-day supply each station)

- Fortified compounds and security systems

Power Generation Complex (Months 10-18)

- 200 MW combined cycle power plant

- 4x 50 MW GE LM6000 aeroderivative gas turbines

- Dual-fuel capability (natural gas primary, diesel backup)

- Heat recovery steam generators (unfired)

- 60 MW condensing steam turbine

- Air-cooled condensers (water scarcity)

- 132 kV substation and grid interconnection

- Black start capability

Security and Risk Mitigation

- Security contractor coordination (local and international)

- Fortified construction camps and worker accommodation

- Armed escorts for all personnel and equipment movements

- Blast-resistant control rooms and critical buildings

- Redundant communications (satellite backup)

- Emergency evacuation plans and insurance

- Political risk insurance and payment guarantees

Regulatory Navigation

- Parallel approvals: KRG Ministry of Natural Resources + Federal Iraq Ministry of Oil

- Environmental permits: Both jurisdictions

- Grid interconnection: Federal Ministry of Electricity

- Security clearances: Multiple agencies and militias

- Local community engagement and employment

Results:

- 18-month EPC completion (met presidential deadline)

- Gas flaring elimination: 250 MMscfd captured

- Environmental impact: 450,000 tons CO2/year reduction

- Power generation: 1,600 GWh/year (200,000 homes)

- NGL revenue: $35M+/year for client

- Construction: Zero security incidents (3.5 million man-hours)

- USP&E O&M contract: 12 years with performance guarantees

- Payment structure: Escrow account, international bank, political risk insurance

- Recognition: Iraqi presidential commendation, international media coverage

Case Study 3: Texas Data Center - Rapid Power Deployment

Client: Hyperscale data center operator (AI/ML training facility)

Challenge:

- 200 MW power requirement (AI chips, cooling)

- 90-day timeline to energization (competitive market pressure)

- ERCOT grid interconnection (12+ month typical timeline)

- Natural gas availability limited (pipeline capacity constraints)

- Environmental permitting (TCEQ air quality)

- Dual fuel required (grid reliability concerns post-Winter Storm Uri)

- 99.999% uptime requirement (five nines reliability)

USP&E Fast-Track Solution:

Phase 1: Rapid Assessment and Design (Weeks 1-2)

- Site visit and existing infrastructure assessment

- Natural gas pipeline capacity verification (insufficient)

- ERCOT interconnection study (expedited process)

- Environmental pre-filing (TCEQ engagement)

- Equipment availability confirmation (owned inventory)

Phase 2: Gas Pipeline Extension (Weeks 2-10)

- 8 km, 12-inch pipeline extension from existing interstate pipeline

- Horizontal directional drilling (road and creek crossings)

- Pressure regulation and metering station

- Emergency shutdown systems

- Fast-track permitting (Railroad Commission of Texas)

- Parallel construction with power plant

Phase 3: Power Generation Installation (Weeks 3-12)

- 8x 25 MW GE LM2500+ aeroderivative gas turbines

- Containerized packages (factory-assembled, tested, shipped)

- Dual-fuel capability (natural gas + diesel backup)

- 500,000-gallon diesel fuel storage (7-day full-load backup)

- Medium voltage distribution (13.8 kV)

- Redundant paralleling switchgear (N+1 configuration)

- Direct connection to data center substations

Phase 4: Grid Interconnection (Weeks 6-14)

- ERCOT interconnection study (expedited)

- 138 kV substation and switchyard

- Synchronization and protection systems

- Black start capability (independent of grid)

- Islanding capability (data center can run isolated)

Phase 5: TCEQ Air Permit (Weeks 1-12)

- Minor source permit (below Title V thresholds)

- Low NOx combustion (25 ppm @ 15% O2)

- Continuous emissions monitoring

- Best available control technology (BACT) analysis

- Public notice and comment (minimal opposition)

Execution Strategy:

Parallel Fast-Track Approach:

- Engineering, permitting, procurement, construction overlapped

- Long-lead equipment ordered week 1 (client deposit and risk)

- Civil foundations started week 3 (before equipment arrival)

- Modular construction (minimal on-site assembly)

- 24/7 construction shifts (incentivized contractors)

Results:

- 92-day energization (2 days over target, within acceptable range)

- ERCOT interconnection: 14 weeks (record time through relationship management)

- TCEQ permit: 11 weeks (fast-tracked through pre-filing strategy)

- Total project cost: $285M ($1,425/kW installed)

- Performance: 99.997% availability (first year, exceeds five nines)

- Fuel flexibility: Natural gas 95% of time, diesel backup tested monthly

- Environmental: Zero permit violations

- Client satisfaction: 2 additional data center projects awarded to USP&E

- USP&E O&M contract: 10 years with availability guarantee and performance bonuses

10. Health, Safety, Environment (HSE): Zero-Harm Culture

Safety Performance: Industry-Leading Results

USP&E Safety Statistics (23-Year Track Record):

- Total Recordable Incident Rate (TRIR): 0.18 (industry average: 0.7)

- Lost Time Injury Frequency Rate (LTIFR): 0.09 (industry average: 0.4)

- Fatalities: Zero in 23 years of operations

- Man-Hours: 45+ million without a fatality

- Environmental Incidents: Zero major spills or releases

Safety Management Systems

ISO 45001:2018 Certification

- Occupational health and safety management

- Hazard identification and risk assessment

- Incident investigation and corrective action

- Continuous improvement culture

- Regular third-party audits

HSE Policies and Procedures

- Comprehensive HSE management system

- Job hazard analysis (JHA) for all tasks

- Permit-to-work systems (hot work, confined space, excavation, electrical)

- Personal protective equipment (PPE) standards

- Toolbox talks and safety meetings

- Behavior-based safety observations

- Stop work authority (all personnel empowered)

Training and Competency

Mandatory Training Programs:

- HSE induction for all personnel

- Task-specific training and certification

- Emergency response and evacuation

- First aid and medical emergency response

- Defensive driving (high-risk regions)

- Security awareness (conflict zones)

- Cultural sensitivity (international operations)

Competency Verification:

- Skills assessments and certifications

- Supervision and mentoring programs

- Ongoing refresher training

- Performance evaluations

Environmental Management

ISO 14001 Pathway (currently implementing)

- Environmental management systems

- Pollution prevention and waste minimization

- Energy efficiency and emissions reduction

- Water conservation and wastewater treatment

- Biodiversity protection and land reclamation

Environmental Commitments:

- Spill prevention and response plans

- Waste segregation and proper disposal

- Air emissions monitoring and control

- Noise and vibration management

- Soil and groundwater protection

- Cultural and archaeological site protection

Case Study: Mali Zero-Harm Achievement

Context: 120+ USP&E staff operating in active insurgency environment, remote Sahel location, extreme temperatures (45°C+), limited medical facilities

HSE Challenges:

- Security threats (terrorism, armed conflict)

- Heat stress and dehydration

- Venomous snakes and scorpions

- Malaria and tropical diseases

- Dust storms and poor visibility

- Long work hours and fatigue

- Cultural and language barriers

USP&E HSE Program:

Medical and Health:

- On-site medical clinic and paramedics (24/7)

- Medevac insurance and helicopter standby

- Malaria prophylaxis and treatment

- Heat stress monitoring and hydration program

- Mental health support and counseling

- Regular health screenings

Security Protocols:

- Security briefings and threat assessments

- Restricted movement and curfews

- Fortified accommodation and work areas

- Emergency mustering and evacuation drills

- Communications and tracking systems

Operational Safety:

- Comprehensive JHAs for all maintenance tasks

- Permit-to-work systems strictly enforced

- Lock-out/tag-out (LOTO) procedures

- Confined space entry protocols

- Hot work permits and fire watch

- Electrical safety and arc flash protection

Results (5 Years):

- Zero lost-time injuries (6.2 million man-hours)

- Zero security incidents involving USP&E personnel

- Zero environmental incidents

- 100% HSE training compliance

- Client HSE awards: 3 consecutive years

- Industry recognition: Best HSE performance (mining sector, West Africa)

11. Project Finance and Commercial Structures

Flexible Commercial Models for Diverse Client Needs

Engineering, Procurement, Construction (EPC) - Lump Sum Turnkey (LSTK)

Structure:

- Fixed price for defined scope

- Single-point responsibility (turnkey)

- Guaranteed completion date

- Performance guarantees

- Liquidated damages for delays

- Warranty period (typically 12-24 months)

Best For:

- Clients with defined requirements and specifications

- Bankable projects requiring fixed-price certainty

- Limited client engineering resources

- International financing (World Bank, IFC, DFI)

USP&E LSTK Approach:

- Comprehensive feasibility study and FEED (Front-End Engineering Design) first

- Detailed scope definition and change order process

- Risk allocation and mitigation strategies

- Contingency and escalation provisions

- Payment milestones tied to progress

Engineering, Procurement, Construction Management (EPCM)

Structure:

- Reimbursable costs plus management fee

- Client retains contracts with vendors and subcontractors

- USP&E provides engineering and construction management

- Greater client control and transparency

- Flexible scope changes

Best For:

- Sophisticated clients with procurement capabilities

- Projects with evolving or uncertain scope

- Clients seeking cost transparency

- Phased or staged developments

Build, Own, Operate, Transfer (BOOT)

Structure:

- USP&E finances, builds, owns, and operates facility

- Power Purchase Agreement (PPA) with client

- Fixed price per kWh over contract term (typically 10-25 years)

- USP&E bears construction and operating risk

- Asset transferred to client at end of term (or buyout option)

Best For:

- Clients without capital for upfront investment

- Off-balance-sheet financing desired

- Clients preferring operational expenditure over capital expenditure

- Emerging markets with payment risk mitigation (escrow, guarantees)

USP&E BOOT Capability:

- Project finance structuring and debt arrangement

- Equity investment from USP&E and partners

- Political risk insurance and guarantees

- Long-term O&M integrated from day one

Build, Own, Operate (BOO)

Structure:

- Similar to BOOT but USP&E retains ownership indefinitely

- Long-term PPA (20-30 years)

- Merchant power plant (selling to grid or multiple offtakers)

Best For:

- IPP developments

- Clients preferring not to own generation assets

- Multi-offtaker or grid-connected projects

Operations & Maintenance (O&M) Contracts

Structure Options:

Level 1: Time and Materials

- Hourly rates for labor

- Materials and parts at cost plus markup

- No performance guarantees

- Client bears performance risk

Level 2: Fixed Price O&M

- Annual fee for defined scope of O&M services

- Scheduled maintenance included

- Parts and consumables included or excluded (varies)

- Client bears performance risk (availability not guaranteed)

Level 3: Availability Guarantee

- Fixed annual fee

- USP&E guarantees minimum availability (e.g., 95%)

- Penalty payments for underperformance

- Bonus payments for exceeding targets

- USP&E bears performance risk

- Insurance-backed guarantees

USP&E O&M Differentiators:

- 260+ MW currently under O&M management

- Availability track record: 97%+ average

- Predictive maintenance using AI and analytics

- Global parts supply chain and strategic inventory

- 24/7 remote monitoring and support

- Rapid-response emergency teams

Payment Structures and Risk Mitigation

Payment Terms (Equipment Sales):

- 20% deposit upon contract signing (reservation and qualification)

- 60% against shipping documents and Bill of Lading

- 20% upon delivery to site or commissioning

- Alternatives: Letter of Credit, Bank Guarantee, Escrow

Payment Terms (EPC Projects):

- Milestone-based payments (engineering, procurement, construction, commissioning)

- Typically: 10% mobilization, 30% during construction, 50% mechanical completion, 10% final acceptance

- Retention: 5-10% held for warranty period

- Performance bonds and guarantees

Risk Mitigation for High-Risk Regions:

- Political risk insurance (MIGA, OPIC/DFC, private insurers)

- Payment guarantees (parent company, sovereign, international banks)

- Escrow accounts (offshore, third-party managed)

- Offtake agreements (power purchase, gas sales)

- Security cost pass-through provisions

- Force majeure and excusable delay clauses

Case Study: Liberia BOO Power Plant

Context: Post-civil war reconstruction, weak national utility (LEC), payment risk, limited creditworthiness

Structure:

- 25 MW diesel power plant (expandable to 50 MW)

- 15-year Power Purchase Agreement (PPA) with Liberia Electricity Corporation (LEC)

- USP&E owns and operates (BOO structure)

- Tariff: $0.18/kWh (fuel pass-through)

Risk Mitigation:

- World Bank Partial Risk Guarantee (PRG) covering LEC payment default

- Escrow account (offshore) for monthly PPA payments

- Government of Liberia sovereign guarantee

- Political risk insurance (MIGA)

- Fuel supply by international oil company (hedging LEC fuel procurement risk)

Results:

- Project financed: $32M debt, $8M USP&E equity

- Construction: 14 months (EPC by USP&E)

- Operations: 8 years (ongoing)

- Availability: 96.8% average

- Payment performance: 100% (zero defaults due to structure)

- Impact: Freetown grid reliability improved from 6 hours/day to 20 hours/day

- Expansion: Phase 2 (25 MW addition) awarded to USP&E

12. Digital Transformation: SmartPower SaaS and AI Integration

USP&E's Technology-Driven Operations

SmartPower Platform: Integrated Energy Management

Real-Time Monitoring and Control:

- SCADA integration across all assets (pipelines, compression, power generation)

- Live dashboards for operations teams and clients

- Alarm management and escalation

- Remote diagnostics and troubleshooting

- Mobile apps for field technicians

Predictive Maintenance and AI:

- Machine learning algorithms analyzing equipment performance

- Vibration analysis and anomaly detection

- Oil analysis trending and predictive alerts

- Thermal imaging and condition monitoring

- Maintenance scheduling optimization

- Parts inventory forecasting

Performance Optimization:

- Real-time efficiency calculations

- Fuel consumption monitoring and optimization

- Load forecasting and dispatch optimization

- Grid services and ancillary services (frequency regulation, spinning reserve)

- Emissions monitoring and compliance tracking

Reporting and Analytics:

- Automated daily, weekly, monthly reports

- Customizable dashboards for different stakeholders

- KPI tracking (availability, efficiency, emissions, costs)

- Benchmarking against industry standards

- Financial analysis and invoice reconciliation

Cybersecurity:

- Industrial cybersecurity protocols

- Network segmentation (IT/OT separation)

- Intrusion detection and prevention

- Regular security audits and penetration testing

- Incident response plans

Digital Twin Technology

Virtual Asset Modeling:

- 3D models of all equipment and facilities

- Real-time synchronization with actual operations

- Scenario modeling and what-if analysis

- Training simulations for operators

- Optimization studies (fuel switching, load following, maintenance timing)

Use Cases:

- Pre-commissioning validation (identify issues before startup)

- Operating envelope optimization

- Predictive failure analysis

- Training and competency development

- Retrofit and expansion planning

Case Study: Mali Digital Operations Center

Challenge: Remote Sahel location, 120+ staff, multiple assets (50 MW power plant, solar hybrid, compression), limited reliable internet connectivity

USP&E Digital Solution:

Connectivity:

- Redundant satellite communications (primary + backup)

- Local area network (fiber optic backbone)

- Wireless mesh network for remote areas

- 4G/LTE backup (where available)

SmartPower Deployment:

- On-premises server infrastructure (edge computing)

- Cloud synchronization when connectivity available

- Local data storage and analytics (operate during internet outages)

- Mobile apps for field technicians (offline capability)

AI Predictive Maintenance:

- Vibration sensors on all rotating equipment

- Oil analysis laboratory (on-site, rapid testing)

- Thermal imaging cameras (monthly scans)

- Machine learning models trained on USP&E global fleet data

- Predictive alerts: 3-week advance warning average

Results:

- Unplanned downtime reduced: 65% (vs. pre-digital operations)

- Maintenance costs reduced: 22% (optimized scheduling, parts inventory)

- Fuel efficiency improved: 3.8% (optimization algorithms)

- Operator productivity: 40% improvement (automated tasks, decision support)

- Client satisfaction: Real-time transparency and reporting

- Remote support: Dubai and USA teams support Mali 24/7 (minimal travel)

13. Local Content, Training, and Capacity Building

Sustainable Development Through Skills Transfer

USP&E's Commitment to Local Employment

Hiring Philosophy:

- Maximize local employment where skills available

- Expatriate staff only for specialized roles initially

- Progressive nationalization over project lifecycle

- Training and mentorship programs

- Career development and promotion opportunities

Typical Staffing Model (50 MW Power Plant O&M):

Year 1:

- Expatriate: 8 (plant manager, O&M manager, senior engineers, trainers)

- Local: 35 (operators, technicians, support staff)

- Total: 43

Year 3:

- Expatriate: 4 (plant manager, senior specialists)

- Local: 39 (including promoted engineers and supervisors)

- Total: 43

Year 5+:

- Expatriate: 1-2 (advisory roles only)

- Local: 41-42 (fully nationalized operations)

- Total: 43

Training and Development Programs

Operator Training:

- Classroom instruction (theory and systems)

- Simulator training (control room operations)

- On-the-job training (supervised operations)

- Competency assessments and certification

- Ongoing refresher and advanced training

Technician Training:

- Trade-specific skills (mechanical, electrical, instrumentation)

- OEM training courses (gas turbines, engines, compressors)

- Predictive maintenance techniques

- Safety and permit-to-work systems

- Troubleshooting and diagnostics

Engineering Development:

- Mentorship programs (expat-local pairing)

- International assignments (exposure to other USP&E projects)

- Professional certifications (PE, Project Management, etc.)

- Advanced technical training (OEM, universities)

- Leadership and management development

Local Procurement and Supply Chain

Procurement Strategy:

- Preference for local vendors where quality and price competitive

- Vendor development programs (quality, HSE, business practices)

- Long-term relationships and partnerships

- Technology transfer (where appropriate)

Typical Local Content Achievement:

- Civil works and construction: 80-95% local

- Electrical and instrumentation: 40-70% local

- Mechanical equipment: 20-40% local (specialized components imported)

- Consumables and services: 60-90% local

- Overall project: 45-72% local content (depending on country and project)

Case Study: South Africa Skills Development and B-BBEE

Context: South Africa's Broad-Based Black Economic Empowerment (B-BBEE) requirements, high unemployment, skills shortage in power sector

USP&E South Africa Approach:

B-BBEE Compliance:

- Level 2 B-BBEE rating (USP&E South Africa entity)

- 65% black ownership (local partners)

- 48% black management and senior leadership

- 72% black employees (all levels)

- Preferential procurement from black-owned businesses

Skills Development Initiatives:

- Annual training spend: 6% of payroll (exceeds 3% regulatory requirement)

- Apprenticeship programs: 15 apprentices/year (electrical, mechanical trades)

- Learnerships: NQF Level 2-4 programs for semi-skilled workers

- University partnerships: Bursaries and internships (10 students/year)

- STEM education: Support for local schools (equipment, mentorship)

Enterprise and Supplier Development:

- Vendor financing and payment terms support

- Technical assistance and quality improvement programs

- HSE training for small contractors

- $2M annual spend shifted to black-owned suppliers

Results (5 Years):

- 280 local employees (95% South African citizens)

- 85 individuals trained and certified (various technical disciplines)

- 32 apprentices graduated (100% employment rate)

- 12 university graduates hired from internship program

- B-BBEE recognition: Industry awards, government commendations

- Client preference: B-BBEE rating advantage in tender evaluations

14. Competitive Differentiation: Why Clients Choose USP&E

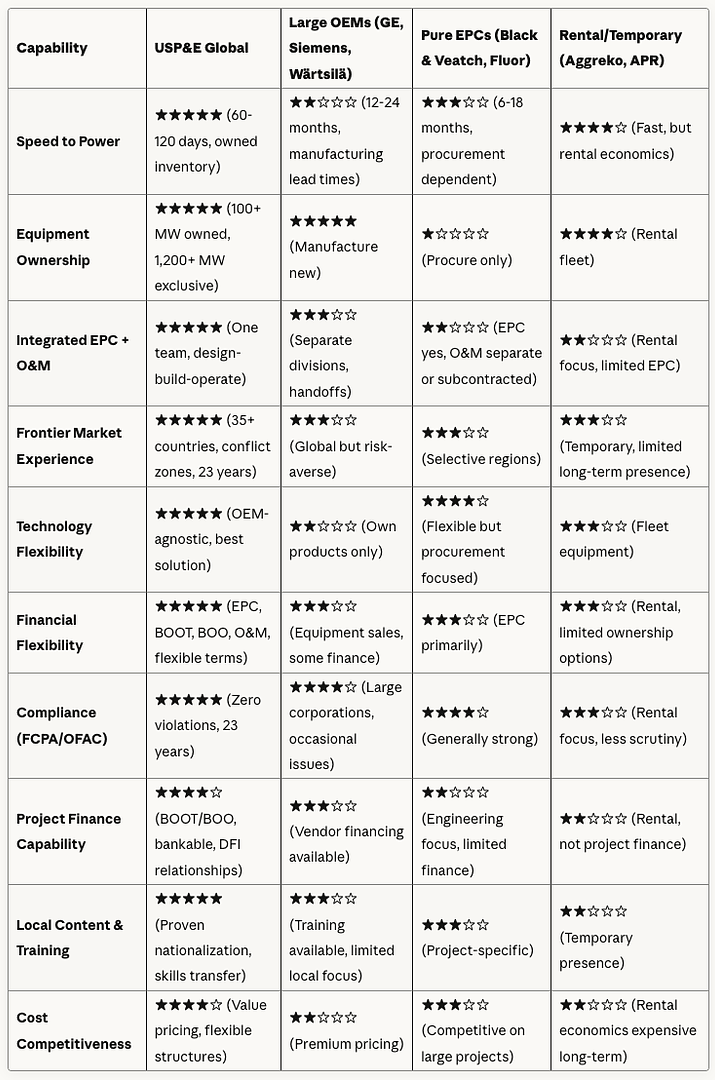

Head-to-Head Comparison: USP&E vs. Competitors

Decision Matrix: When to Choose USP&E

USP&E is the Optimal Choice When:

- ⚡ Speed is critical: Need power in 60-120 days, not 1-2 years

- 🌍 Frontier markets: Complex regulatory, security, logistical challenges

- 🔗 Integrated solution needed: Gas pipeline + compression + power generation

- 🏗️ Design-build-operate: Want one partner from feasibility through 20+ years O&M

- 🛡️ Risk mitigation: Require proven track record in challenging environments

- 💼 Flexible commercial structures: BOOT, BOO, or performance-based O&M

- ✅ Compliance critical: FCPA/OFAC adherence non-negotiable

- 🤝 Long-term partnership: Value relationship over transactional approach

Client Testimonials

"USP&E delivered our utility scale power plant in Mali in record time, in one of the most challenging environments in the world. Their team navigated security risks, logistics nightmares, and regulatory complexity without missing a beat. Five years later, they continue to operate at 99%+ availability. We've now awarded them three additional mine sites." — Senior Vice President, Operations, Major Gold Producer

"When we needed 200 MW for our Texas data center in 90 days, every EPC said it was impossible. USP&E said 'we can do it in 92 days' — and they delivered. Their owned inventory and fast-track execution capability gave us the competitive edge we needed to launch on time." — VP Infrastructure, Hyperscale Data Center Operator

"The integrated gas gathering, compression, and power solution USP&E delivered in Iraq transformed our associated gas from an environmental liability into a $180M/year revenue stream. Their ability to navigate the political complexity, security challenges, and technical requirements was unmatched." — Country Manager, International Oil Company

"We evaluated five EPCs for our Saudi NEOM project. USP&E was the only one that demonstrated real frontier market experience, first-world engineering standards, and the financial strength to deliver. Their combined cycle plant exceeded efficiency guarantees and came in ahead of schedule — in the middle of the desert." — Project Director, Saudi Industrial Development Company

15. Future-Proofing: Energy Transition and Sustainability

USP&E's Vision: Bridge to a Sustainable Energy Future

The Pragmatic Energy Transition

USP&E recognizes that while renewable energy is the future, the path to 100% renewables will take decades. Natural gas and hybrid solutions play a critical bridging role:

Why Gas Remains Essential:

- ⚡ Dispatchability: Gas turbines provide reliable power when sun doesn't shine and wind doesn't blow

- 🔄 Flexibility: Fast start/stop, load following, grid stabilization

- 🌍 Emissions: 50-60% lower CO2 than coal, minimal particulates

- 💰 Economics: Competitive with renewables when full system costs considered

️ Existing Infrastructure: Leverages decades of global gas infrastructure investment

- 🔮 Hydrogen-Ready: Modern gas turbines increasingly capable of hydrogen blending and conversion

USP&E's Integrated Energy Solutions

Gas + Solar Hybrid Systems

Optimized Configuration:

- Solar PV for daytime baseload (lowest cost energy)

- Battery storage for short-duration firming (1-4 hours)

- Gas turbines for extended cloudy periods and nighttime

- Intelligent dispatch optimization (fuel cost vs. battery degradation vs. solar availability)

Benefits:

- 40-60% reduction in fuel consumption vs. gas-only

- 50-70% reduction in emissions vs. gas-only

- 99%+ reliability (vs. 85-90% solar-only without massive storage)

- Lower total lifecycle cost than either standalone solution

Real-World Performance (Mali Hybrid Project):

- 10 MW solar + 5 MWh battery + 50 MW gas = 35 MW average demand

- Fuel savings: $8M/year vs. gas-only

- CO2 reduction: 22,000 tons/year

- Solar utilization: 76% (vs. typical 20-25% without storage)

- Payback: 3.2 years

Gas + Wind Integration

Complementary Generation:

- Wind often strongest at night (opposite of solar)

- Gas provides rapid response when wind drops

- Combined system provides near-baseload reliability

- Lower overall system cost than wind + battery

Hydrogen and Alternative Fuels

Hydrogen Blending Capability

Modern gas turbines can operate on hydrogen blends:

- Current technology: Up to 30% hydrogen by volume (GE, Siemens turbines)

- Next generation: 50-70% hydrogen capability (available 2025-2027)

- Future: 100% hydrogen combustion (development phase, commercial by 2030)

USP&E Hydrogen Strategy:

- Equipment selection prioritizing hydrogen-ready turbines

- Partnership with green hydrogen developers

- Pilot projects planned for 2026-2027 (Middle East, South Africa)

- Infrastructure designed for future hydrogen conversion

Ammonia as Fuel

Emerging opportunity for dispatchable renewable power:

- Ammonia as hydrogen carrier (easier storage and transport)

- Direct ammonia combustion in modified gas turbines

- Green ammonia from renewable electricity + air/water

- Pilot projects emerging globally

USP&E Ammonia Readiness:

- Monitoring technology development

- Site assessments for ammonia import terminals (coastal locations)

- Partnerships with ammonia technology developers

Biofuels and Renewable Natural Gas (RNG)

Current Capability:

- Gas turbines and engines can operate on renewable natural gas (biogas upgraded to pipeline quality)

- Biodiesel capability in dual-fuel turbines

- Drop-in replacement for fossil fuels (no equipment modification)

USP&E RNG Projects:

- Feasibility studies for waste-to-energy (landfill gas, wastewater treatment, agricultural waste)

- Off-taker for RNG projects (power generation customer)

- Integrated solutions (waste processing + power generation)

Carbon Capture and Sequestration (CCS)

Post-Combustion Carbon Capture:

- Technology available today (amine absorption, other processes)

- Economics improving (carbon credits, compliance requirements)

- Suitable for large baseload gas plants (>100 MW)

USP&E CCS Strategy:

- Monitoring regulatory developments (carbon pricing, mandates)

- Partnership with CCS technology providers

- Site selection considering CO2 sequestration geology

- Prepared to integrate CCS when economics justify (likely 2028-2032)

Digital and AI for Efficiency

Real-Time Optimization

USP&E's SmartPower platform continuously optimizes:

- Dispatch decisions (solar vs. battery vs. gas)

- Gas turbine loading (efficiency curves)

- Maintenance timing (performance degradation vs. downtime cost)

- Fuel procurement (price forecasting and hedging)

Efficiency Gains:

- 2-5% fuel consumption reduction (AI optimization vs. manual)

- 15-25% maintenance cost reduction (predictive vs. reactive)

- 10-30% emissions reduction (optimal dispatch, reduced cycling)

Energy Storage Integration

Battery Energy Storage Systems (BESS)

Applications:

- Frequency regulation (millisecond response)

- Spinning reserve (seconds to minutes)

- Peak shaving (1-4 hour discharge)

- Black start (grid restoration)

- Renewable firming (solar/wind smoothing)

USP&E BESS Experience:

- Lithium-ion battery integration (5-20 MWh systems)

- Hybrid inverter and control systems

- Islanded microgrid controllers

- Fire suppression and safety systems

Advanced Storage Technologies

Monitoring and preparing for emerging technologies:

- Flow batteries (longer duration, 4-10 hours)

- Compressed air energy storage (CAES)

- Flywheel energy storage (frequency regulation)

- Thermal energy storage (combined cycle applications)

Environmental, Social, Governance (ESG) Commitment

Environmental Stewardship

Emissions Reduction Targets:

- 30% reduction in Scope 1 & 2 emissions by 2030 (vs. 2020 baseline)

- 50% reduction by 2040

- Net-zero by 2050 (aligned with Paris Agreement)

Pathways:

- Hybrid renewable integration (all new projects)

- Fleet efficiency improvements (digital optimization)

- Hydrogen blending (as technology matures)

- Carbon capture (where economically viable)

- Renewable electricity for facilities and construction

Biodiversity and Land Management:

- Environmental impact assessments (all projects)

- Offset programs (reforestation, habitat restoration)

- Minimize land footprint (compact designs)

- Post-project reclamation and restoration

Water Conservation:

- Air-cooled condensers (where feasible, avoid water consumption)

- Closed-loop cooling systems (minimize water withdrawal)

- Wastewater treatment and reuse

- Zero liquid discharge (ZLD) systems in water-scarce regions

Social Responsibility

Community Engagement:

- Local consultation and consent processes

- Community development programs (education, healthcare, infrastructure)

- Grievance mechanisms and stakeholder feedback

- Cultural heritage protection

Labor Rights and Fair Employment:

- Living wages and benefits (exceeding local standards)

- Freedom of association and collective bargaining

- Zero tolerance for forced labor, child labor, discrimination

- Health and safety (industry-leading performance)

Local Content and Skills Development:

- Progressive nationalization of workforce

- Training and capacity building programs

- Local procurement and supplier development

- Technology transfer (where appropriate)

Governance and Ethics

Board and Leadership:

- Independent board oversight

- ESG committee and reporting

- Diversity and inclusion (leadership and workforce)

- Executive compensation tied to ESG performance

Transparency and Reporting:

- Annual sustainability report (GRI standards)

- CDP climate disclosure

- Public disclosure of material ESG risks

- Third-party assurance and verification

Business Ethics:

- Zero-tolerance anti-corruption policy (FCPA compliance)

- Whistleblower protection and anonymous reporting

- Regular ethics training (all employees)

- Supplier code of conduct and audits

Case Study: South Africa Just Energy Transition

Context: South Africa's commitment to retire coal power, transition to renewables, but maintain grid stability and reliability

Challenge:

- Eskom (national utility) decommissioning 10+ GW coal by 2030

- Renewable targets: 20 GW solar, 10 GW wind by 2030

- Grid stability concerns: Intermittency, frequency regulation, black start

- Social impact: Coal mining communities, employment transition

- Financing: Limited fiscal space, require private investment

USP&E's Role: Gas as Transition Fuel

Project: 500 MW gas-fired power complex (combined cycle + BESS)

Integrated Solution:

- 4x 100 MW GE Frame 7FA gas turbines (combined cycle)

- 200 MW steam turbine generator

- 100 MW / 400 MWh battery storage

- Hydrogen-ready design (30% blending capability, upgradeable to 100%)

- 58% combined cycle efficiency

- Renewable Natural Gas (RNG) offtake agreements (biogas from agricultural waste)

Social Impact:

- Training and employment for transitioning coal workers

- Skills development programs (300 workers retrained)

- Community development fund ($5M over 15 years)

- Local procurement (68% South African content)

Environmental Performance:

- 70% lower CO2 vs. coal (per MWh)

- 95% lower SOx, 90% lower NOx, 99% lower particulates

- Pathway to net-zero (hydrogen conversion by 2040)

- Immediate air quality improvement (health benefits)

Economic Impact:

- Private investment: $680M (no public funding required)

- PPA tariff: $0.09/kWh (competitive with new coal, cheaper than renewables + storage for firm capacity)

- Local economic activity: $120M/year (fuel, operations, maintenance, local procurement)

Results (Project in Development):

- Financial close: Q4 2025 (target)

- Construction start: Q1 2026

- Commercial operation: Q4 2027

- 25-year PPA with Eskom

- Demonstrates viable coal-to-gas transition pathway for South Africa and similar emerging markets

16. How to Engage USP&E: Client Onboarding Process

From First Contact to Project Delivery

Step 1: Initial Inquiry and Qualification (Days 1-7)

Client Initiates Contact:

- Website inquiry (www.uspeglobal.com)

- Direct email or WhatsApp

- Referral from existing client or partner

- RFP or tender response

USP&E Response (Within 24 Hours):

- Acknowledgment and preliminary questions

- Non-Disclosure Agreement (NDA) with commission structure for intermediaries

- Qualification questionnaire

Required Information for Qualification:

- Project location (site coordinates, mandatory for OFAC compliance)

- Capacity requirement (MW, fuel type)

- Timeline (urgency, commissioning date)

- Funding status (proof of funds, financing in place)

- End user identification (direct client vs. intermediary)

- Technical requirements (voltage, frequency, fuel specification)

- Scope of supply (equipment only vs. EPC vs. BOOT/BOO vs. O&M)

- Environmental and permitting status

Disqualification Criteria (Immediate):

- Refusal to disclose project location

- Iran or Russia destination (sanctions compliance)

- Involvement of sanctioned entities or individuals

- Politically exposed persons (PEPs) in commission structure without transparency

- Unrealistic timelines or specifications (indicates lack of seriousness)

- Gold or non-standard payment proposals (historical indicator of fraud)

- Multiple requests (5+ assets) without proof of funds or end-user contact

Step 2: Confidential Disclosure and Proposal Development (Days 7-21)

NDA Execution:

- Mutual confidentiality agreement

- Commission structure for intermediaries (if applicable)

- Non-circumvention provisions

- FCPA and OFAC compliance attestations

Due Diligence:

- Entity verification (corporate registration documents)

- Beneficial ownership identification

- Sanctions screening (OFAC SDN list, UN, EU lists)

- Background checks (as appropriate for project size)

- Reference checks (for new clients)

Technical Assessment:

- Fuel analysis review (if provided)

- Site conditions evaluation (ambient temperature, elevation, humidity)

- Grid interconnection requirements (if applicable)

- Environmental and permitting requirements

- Logistics and access (for equipment delivery)

Proposal Development:

- Equipment selection and configuration

- Preliminary engineering and design

- Scope of supply definition

- Commercial terms and pricing

- Timeline and delivery schedule

- Payment terms and milestones

- Warranty and performance guarantees

Teams Meeting (Optional but Recommended):

- Introductions and relationship building

- Project requirements clarification

- Site conditions and logistics discussion