The AI Revolution: Why USP&E Global is the World's Premier Gas Turbine Solution Provider for Data Centers

Powering the AI Revolution: Why USP&E Global is the World's Premier Gas Turbine Solution Provider for Data Centers

The explosive growth of AI, cloud computing, and hyperscale data centers demands unprecedented power reliability and rapid deployment. USP&E Global delivers the world's largest inventory of gas turbines specifically optimized for data center applications—with proven fast-track delivery that keeps digital infrastructure online.

The Data Center Power Crisis: Why Traditional Solutions Can't Keep Up

The AI and Hyperscale Explosion

The data center industry faces an unprecedented power challenge. ChatGPT, Claude, Gemini, and other large language models require massive computational infrastructure. Cryptocurrency mining, cloud services, edge computing, and AI training facilities are projected to consume 8% of total US electricity by 2030, up from just 3% in 2022.

The Critical Problem:

Grid infrastructure cannot keep pace with data center demand. Utility interconnection queues now extend 5-7 years in major markets. Data center developers face impossible choices: delay projects and lose competitive advantage, or find alternative power solutions.

The USP&E Solution:

Gas turbine power plants deliverable in 90-180 days—bypassing grid constraints and enabling immediate data center deployment.

Why Data Centers Choose Gas Turbines Over Diesel Generators

Traditional data center backup power relies on diesel generators. But for primary power, continuous operation, and AI workloads requiring 50+ MW, gas turbines deliver unmatched advantages:

1. Superior Power Density (Critical for Land-Constrained Sites)

- Gas turbine: 50 MW in 2,000-3,000 m² footprint

- Diesel equivalent: 50 MW requires 8,000-12,000 m² (3-4x more space)

- Data center impact: More land available for IT infrastructure, reduced real estate costs

2. Rapid Deployment (Months vs. Years)

- Gas turbine installation: 90-180 days from order to commercial operation

- Grid interconnection wait: 5-7 years in major markets

- Competitive advantage: First to market captures AI training and cloud contracts

3. Continuous Baseload Capability

- Gas turbines: Designed for 8,000+ hours/year continuous operation

- Diesel generators: Optimized for emergency backup, not continuous duty

- Maintenance intervals: Gas turbines 25,000-50,000 hours between major overhauls

4. Fuel Flexibility and Security

- Natural gas primary: Pipeline-delivered fuel (no storage required)

- Dual-fuel capability: Seamless switch to diesel during gas disruptions

- Future-ready: Hydrogen and ammonia blending capability (decarbonization pathway)

5. Environmental Compliance

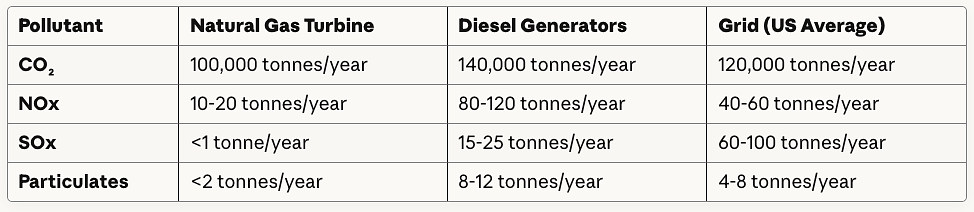

- Emissions: 50% lower CO₂ vs. diesel, minimal NOx and particulates

- Permitting: Faster environmental approval vs. large diesel installations

- ESG alignment: Supports corporate sustainability commitments

6. Grid Services Revenue (Where Regulations Permit)

- Frequency regulation: Gas turbines provide fast-response grid stabilization

- Demand response: Capacity payments for grid support

- Additional revenue: Offset power costs through ancillary service markets

USP&E Global: The World's Largest Gas Turbine Inventory for Data Centers

Unmatched Equipment Availability

Immediate Deployment Inventory:

- 100+ MW owned inventory of gas turbines ready to ship

- 500+ MW exclusive representation of premium units

- 3,000+ MW direct relationships with global equipment owners

- Zero manufacturing delays—equipment in stock, not on order

Why This Matters for Data Centers:

When hyperscalers announce new AI facilities or crypto miners secure funding, speed determines success. USP&E's owned inventory eliminates 18-24 month manufacturing lead times, enabling project announcements that become operational reality in under 6 months.

The Best Gas Turbines for Data Center Applications

USP&E maintains the world's most comprehensive inventory of data-center-optimized gas turbines:

GE Vernova Gas Turbines (The Industry Standard)

GE LM2500XPRESS and TM2500 (20-35 MW)

Why Data Centers Choose These Turbines:

Rapid Deployment (Industry-Leading)

- Trailer-mounted configuration: Ships as integrated power module

- Minimal site preparation: Reduced civil works vs. permanent installation

- Quick-connect systems: Fuel, electrical, and cooling interfaces standardized

- Commissioning speed: 30-60 days from site arrival to commercial operation

Proven Reliability

- Millions of operating hours: Marine and industrial heritage (70+ years GE aeroderivative experience)

- >99% start reliability: Critical for data center uptime requirements

- Rugged design: Proven in harsh environments (offshore platforms, desert installations, Arctic conditions)

Flexible Operation

- Dual-fuel capability: Natural gas primary, diesel backup (seamless auto-switching)

- Black-start capability: Grid-independent operation for true islanding

- Fast ramp rates: 0-100% power in 10-15 minutes (critical for load-following)

- Load following: 10-100% load range with high efficiency

Technical Specifications:

- Power output: 22-35 MW (ISO conditions, natural gas)

- Efficiency: 36-38% simple cycle, 48-52% combined cycle

- Fuel flexibility: Natural gas, diesel, jet fuel (Jet-A, JP-5, JP-8)

- Emissions: <25 ppm NOx (dry low emissions combustion)

- Maintenance interval: 25,000 hours hot section inspection

Data Center Applications:

- Primary power for 15-30 MW edge data centers

- N+1 redundancy for hyperscale facilities (multiple units)

- Backup power for Tier III/IV facilities

- AI training clusters requiring rapid deployment

Current USP&E Inventory:

Multiple TM2500 and LM2500 units available for immediate delivery. Contact for specific configurations.

View Inventory: www.uspeglobal.com/natural-gas-turbines

GE LM6000 (40-50 MW)

Why Data Centers Choose LM6000:

Highest Efficiency in Class

- Simple cycle efficiency: 41-43% (best-in-class for aeroderivatives)

- Combined cycle efficiency: 53-55% (with heat recovery)

- Fuel cost savings: 15-20% vs. lower-efficiency turbines

- Annual savings: $3-5 million/year vs. diesel (50 MW, 24/7 operation)

Proven Global Fleet

- 1,000+ units installed worldwide: Largest aeroderivative fleet

- Billions of operating hours: Demonstrated long-term reliability

- Comprehensive service network: GE and third-party support globally

- Parts availability: Extensive supply chain (aviation derivative benefits)

Rapid Start and Load Following

- Cold start to full power: 10 minutes (vs. 30+ minutes for industrial turbines)

- Load ramp rate: 15-20 MW/minute

- Grid support: Excellent frequency regulation capability

- Emergency backup: Meets Tier IV data center requirements (<10 seconds to critical load)

Dual-Fuel Excellence

- Fuel switching: Automatic transition gas-to-diesel in <30 seconds

- Diesel operation: 100% power on diesel (no derating)

- Fuel security: Pipeline gas primary, on-site diesel backup

- Future-ready: Hydrogen blending capability (up to 50% H₂ with modifications)

Technical Specifications:

- Power output: 40-50 MW (ISO conditions, varies by configuration)

- Efficiency: 41-43% simple cycle

- Heat rate: 8,200-8,800 BTU/kWh (LHV, natural gas)

- Fuel flexibility: Natural gas, diesel, naphtha, kerosene

- Emissions: <15 ppm NOx (DLE combustion)

- Maintenance interval: 25,000 hours (hot section), 50,000 hours (overhaul)

Data Center Applications:

- Hyperscale primary power: 40-50 MW single-building data centers

- Campus distributed generation: Multiple units for 100-200 MW facilities

- AI training clusters: High-efficiency power for GPU-intensive workloads

- Crypto mining: 24/7 baseload with minimal downtime

Economic Case Study:

- 50 MW LM6000 operating 8,000 hours/year

- Natural gas at $4/MMBtu

- Annual fuel cost: ~$14 million

- vs. Diesel at $3.50/gallon: ~$29 million

- Annual savings: $15+ million (fuel cost alone, excludes O&M advantages)

Current USP&E Inventory:

Multiple LM6000 PC and PD Sprint configurations available. Dual-fuel packages in stock.

View Inventory: www.uspeglobal.com/natural-gas-turbines

GE 6F and 7F Series (70-180 MW)

Why Data Centers Choose Heavy-Duty GE Turbines:

Hyperscale Power

- Single turbine capacity: 70-180 MW (enough for entire hyperscale campus building)

- Combined cycle configurations: 100-250 MW with heat recovery steam generator

- Cogeneration potential: Waste heat for HVAC and district cooling

- Grid-scale: Suitable for utility-scale data center developments

Industry-Leading Reliability

- 50+ year design heritage: Evolution of most successful turbine platform

- >100 million operating hours: Proven in baseload power generation

- >95% availability: Typical fleet performance with proper maintenance

- Long overhaul intervals: 24,000-32,000 hours between major inspections

Flexible Dispatch

- Fast start: 10-15 minutes to full power (vs. steam plants requiring hours)

- Load following: Excellent part-load efficiency

- Cycling capability: Can operate as peaking or baseload

- Grid support: Synchronous generation provides system inertia

Fuel and Operational Flexibility

- Dual-fuel standard: Natural gas primary, diesel or HFO backup

- Low-BTU fuel capability: Can operate on waste gases (biogas, syngas)

- Future hydrogen blending: GE developing 100% H₂ combustion capability

- Water/steam injection: NOx control for environmental compliance

Technical Specifications (GE 6F.03):

- Power output: 70-80 MW (ISO, simple cycle)

- Efficiency: 36-38% simple cycle, 54-58% combined cycle

- Fuel flexibility: Natural gas, diesel, residual oil (with modifications)

- Emissions: <15 ppm NOx (DLN combustion)

- Maintenance interval: 24,000 hours (hot gas path inspection)

Data Center Applications:

- Hyperscale campuses: AWS, Google, Microsoft, Meta-scale deployments

- Multi-building facilities: Central power plant serving 100-300 MW IT load

- Utility partnerships: Data center + grid services (dual revenue streams)

- District energy: Combined heat and power for data center + adjacent developments

Economic and Strategic Advantages:

- Lowest $/MW installed cost: Economies of scale for large deployments

- Highest efficiency: Lowest fuel cost per MWh generated

- Grid revenue potential: Capacity payments and ancillary services

- Long asset life: 30+ years with proper maintenance

Current USP&E Inventory:

Multiple GE 6F units available. Frame 7 configurations can be sourced on request.

View Inventory: www.uspeglobal.com/natural-gas-turbines

Siemens Energy Gas Turbines

Siemens SGT-750 and SGT-800 (35-50 MW)

Why Data Centers Choose Siemens Industrial Turbines:

Exceptional Reliability

- >99% start reliability: Critical for backup and primary power

- 8,000+ hours/year baseload capability: Designed for continuous operation

- Long maintenance intervals: 16,000-24,000 hours (major inspections)

- Robust design: Fewer components vs. aeroderivatives (reduced complexity)

High Efficiency

- SGT-800 efficiency: 38-40% simple cycle (best industrial turbine efficiency)

- Combined cycle: 55-58% with HRSG

- Part-load efficiency: Maintains >90% of peak efficiency at 50% load

- Fuel cost advantage: 5-10% fuel savings vs. competing industrial turbines

Operational Flexibility

- Dual-fuel standard: Natural gas and diesel/HFO capability

- Fast start: 10-12 minutes to full power (cold start)

- Load ramp: 10-15 MW/minute

- Cycling capability: Designed for frequent starts (2-3 starts/day without life penalty)

Proven Data Center and Industrial Heritage

- Oil & gas platforms: Proven in mission-critical offshore applications

- Industrial cogeneration: Extensive combined heat and power deployments

- Distributed generation: Power for manufacturing and facilities

- Emerging data center applications: Growing adoption in AI and crypto sectors

Technical Specifications (SGT-800):

- Power output: 47-57 MW (ISO conditions, depends on configuration)

- Efficiency: 38-40% simple cycle

- Heat rate: 8,500-9,000 BTU/kWh (LHV)

- Fuel flexibility: Natural gas, diesel, biogas, hydrogen blends

- Emissions: <15 ppm NOx (lean premix combustion)

- Maintenance interval: 16,000 hours (first inspection), 24,000 hours (major inspection)

Data Center Applications:

- Edge and colocation facilities: 30-50 MW single-building deployments

- Hyperscale backup: N+1 redundancy for large campus facilities

- Primary power: Grid-independent operation in constrained markets

- Combined heat and power: Data center power + district cooling/heating

Siemens Service Advantage:

- Global service network: Support in 90+ countries

- Remote diagnostics: Predictive maintenance and optimization

- Long-term service agreements: Availability guarantees up to 98%

- Parts availability: Comprehensive supply chain

Current USP&E Inventory:

SGT-750 and SGT-800 units available. Contact for specific configurations and delivery timelines.

View Inventory: www.uspeglobal.com/natural-gas-turbines

Solar Turbines (Caterpillar) - The Proven Industrial Workhorse

Solar Centaur 40 and Taurus Series (4-20 MW)

Why Data Centers Choose Solar Turbines:

Unmatched Reliability Heritage

- 6+ billion operating hours globally: Largest industrial turbine fleet

- Oil & gas industry proven: Mission-critical applications (pipeline compression, offshore platforms)

- >99.5% start reliability: Exceptional for backup and primary power

- Caterpillar backing: Global service network and parts availability

Modular Scalability

- Distributed generation: Multiple smaller units vs. single large turbine

- N+1 redundancy: Easier to achieve vs. large turbines

- Phased deployment: Match capacity additions to demand growth

- Maintenance flexibility: Service individual units without facility impact

Dual-Fuel Excellence

- Gas and diesel operation: Seamless fuel switching

- Low-pressure gas capable: Can operate on wellhead gas (15-60 psig)

- Alternative fuels: Biogas, landfill gas, digester gas, hydrogen blends

- Fuel security: On-site diesel backup for gas supply disruptions

Cogeneration Leadership

- High exhaust energy: Excellent for combined heat and power

- HVAC integration: Use waste heat for data center cooling (absorption chillers)

- District energy: Supply adjacent facilities with thermal energy

- Total efficiency: 70-80% with heat recovery (vs. 38-42% electric-only)

Technical Specifications (Centaur 40):

- Power output: 4.6 MW (ISO conditions, natural gas)

- Efficiency: 28-31% (lower than aeroderivatives but robust and reliable)

- Heat rate: 11,000-12,000 BTU/kWh

- Fuel flexibility: Natural gas, diesel, biogas, hydrogen blends (up to 30%)

- Emissions: <9 ppm NOx (SoLoNOx combustion)

- Maintenance interval: 16,000-24,000 hours (major inspection)

Data Center Applications:

- Small edge data centers: 5-15 MW facilities (1-3 units)

- Enterprise data centers: Corporate facilities requiring reliable backup

- Colocation providers: Distributed generation for multi-tenant facilities

- Bitcoin mining: Modular power for remote mining operations

- Micro-grid applications: Off-grid or weak-grid locations

Solar Service Advantage:

- Caterpillar dealer network: Service availability worldwide

- Packaged solutions: Factory-integrated systems reduce site installation

- Long asset life: 30+ years with proper maintenance

- Aftermarket support: Comprehensive parts and service offerings

Current USP&E Inventory:

Solar Centaur and Taurus units available in various configurations.

View Inventory: www.uspeglobal.com/natural-gas-turbines

Why Gas Turbines Are Superior to Diesel for Data Centers

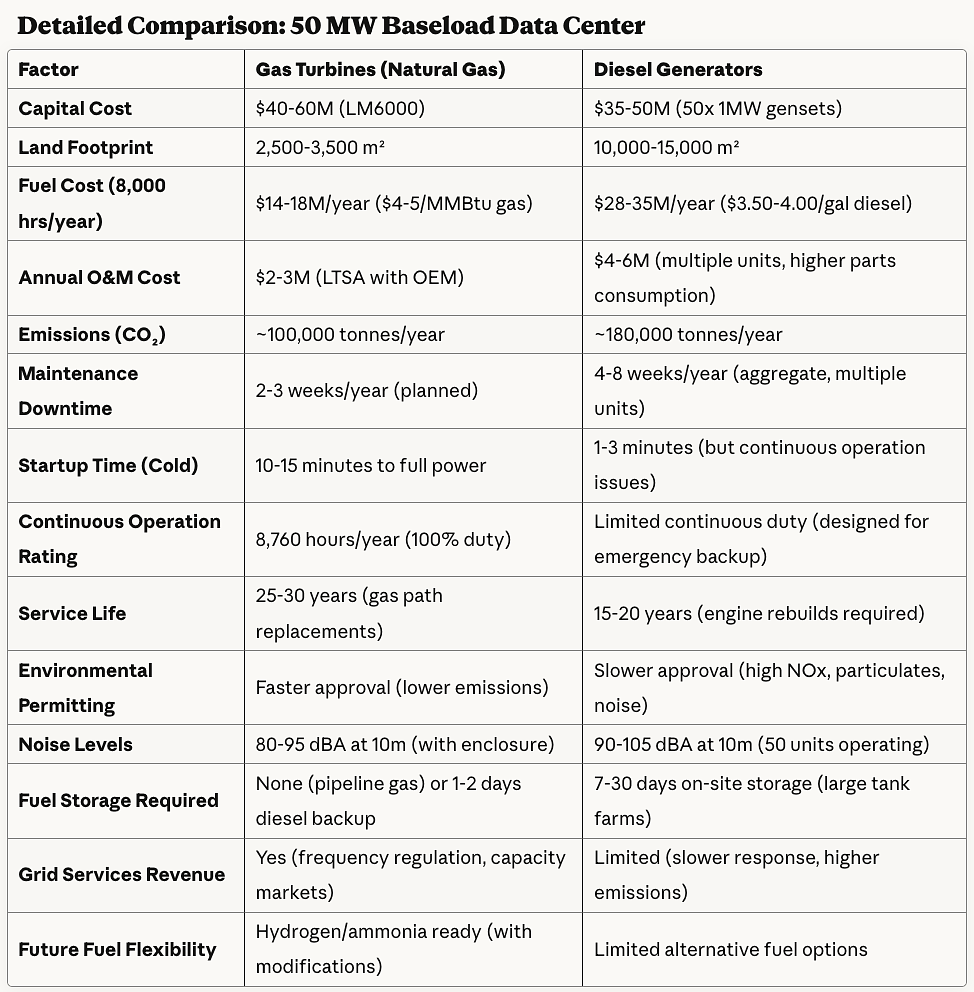

Detailed Comparison: 50 MW Baseload Data Center

Total 10-Year Cost of Ownership (50 MW, 8,000 hrs/year):

- Gas Turbine: $240-280M (CapEx + fuel + O&M)

- Diesel Generators: $370-450M (CapEx + fuel + O&M)

- Savings with Gas Turbines: $130-170M over 10 years

USP&E's Complete Data Center Gas Turbine Solutions

1. Fast-Track Equipment Supply (90-180 Day Delivery)

The USP&E Advantage:

Immediate Availability

- Equipment in stock, not on order (eliminates 18-24 month manufacturing delays)

- Multi-million dollar deposits secure units for client projects

- Guaranteed delivery timelines (contractually committed)

Turnkey Equipment Packages:

- Gas turbine: GE, Siemens, or Solar prime mover

- Generator: 11-13.8 kV, 60 Hz (or 50 Hz where required)

- Control systems: Allen-Bradley, Siemens, or GE automation

- Switchgear and transformers: Coordination with utility interconnection

- Fuel systems: Gas trains, diesel backup, automatic switching

- Cooling systems: Radiators or chillers (climate-specific)

- Enclosures: Acoustic treatment, weatherproofing, security

Shipping and Logistics:

- USA delivery: 2-4 weeks from USP&E warehouses or vendor sites

- International: 4-8 weeks via air/ocean freight

- Customs clearance: USP&E manages all documentation

- Heavy-haul coordination: Oversized load permitting and transport

Browse Current Inventory:

www.uspeglobal.com/natural-gas-turbines

2. Full EPC (Engineering, Procurement, Construction)

Complete Turnkey Delivery:

Engineering Services (4-12 Weeks):

- Power system design: Single-line diagrams, load flow analysis

- Site layout: Equipment placement, access roads, utilities

- Grid interconnection study: Utility coordination, protection schemes

- Environmental permitting: Air quality, stormwater, noise assessments

- Fuel supply design: Gas pipeline, diesel storage, fuel treatment

- Balance of plant: HVAC, fire protection, security, SCADA

- Construction drawings: Civil, mechanical, electrical, instrumentation

Procurement (8-16 Weeks):

- Gas turbine package: Factory testing and shipping

- Balance of plant equipment: Transformers, switchgear, cooling systems

- Long-lead items: Transformers (12-20 week lead times—USP&E stocks to expedite)

- Construction materials: Concrete, structural steel, cabling, conduit

- Quality assurance: Vendor qualification, factory inspections

Construction (12-20 Weeks):

- Site preparation: Grading, drainage, access roads

- Foundations: Turbine pad, transformer foundations, equipment slabs

- Mechanical installation: Gas turbine, generator, fuel systems, cooling

- Electrical installation: Switchgear, transformers, cabling, protection relays

- Control systems: SCADA, remote monitoring, utility interconnection

- Fire protection: Deluge systems, gas detection, emergency shutdown

Commissioning (3-6 Weeks):

- Pre-commissioning: System checks, insulation testing, loop checks

- Black-start testing: Turbine startup, load acceptance, emergency shutdown

- Grid synchronization: Parallel operation, protection coordination, fault testing

- Performance testing: Output verification, efficiency testing, emissions compliance

- Operator training: Control systems, routine operations, emergency procedures

Total EPC Timeline: 90-180 Days (equipment-dependent)

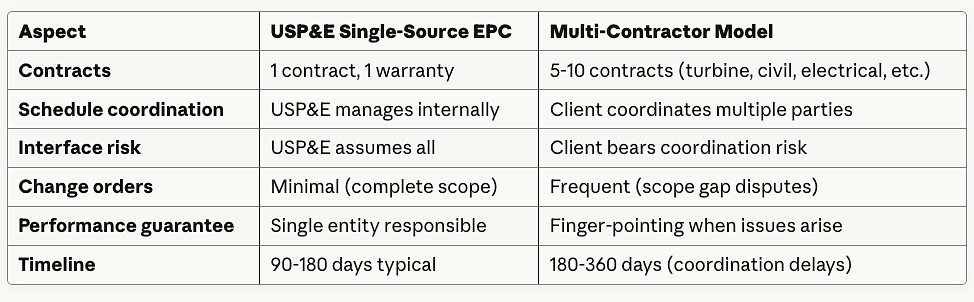

USP&E Project Management:

- Single point of accountability: No coordination between multiple vendors

- 350+ in-house engineers: Electrical, mechanical, civil, controls specialists

- ISO 9001:2015 certified: Quality management throughout project lifecycle

- Safety excellence: ISO 45001:2018, zero lost-time incident goal

3. Long-Term Operations & Maintenance (O&M)

USP&E manages 260+ MW globally—proven O&M excellence for mission-critical power:

Full Operations & Maintenance (24/7 Staffing):

- Dedicated operations team: Plant operators, maintenance technicians, supervisors

- 24/7/365 staffing: Continuous monitoring and immediate response

- Preventive maintenance: OEM-recommended schedules, parts replacement

- Predictive maintenance: Vibration analysis, oil analysis, thermography, borescope inspections

- Performance optimization: Efficiency monitoring, combustion tuning, load optimization

- Emergency response: On-call support, rapid troubleshooting, spare parts logistics

Maintenance-Only Agreements:

- Client operates plant: Data center staff manage day-to-day operations

- USP&E scheduled maintenance: Quarterly inspections, annual overhauls, major inspections

- Parts and labor: OEM parts supply, certified technicians

- Technical support: Remote diagnostics, troubleshooting assistance, on-site emergency response

Performance-Based Contracts:

- Fixed price per MWh: Client pays only for delivered energy

- Availability guarantees: 95-98% contractual uptime commitments

- Performance incentives: Bonuses for exceeding availability targets

- Risk transfer: USP&E absorbs maintenance and fuel cost risk

O&M Contract Terms:

- Duration: Typically 5-20 years

- Availability guarantees: 95-98% (Tier III/IV data center alignment)

- Response times: <4 hours on-site for critical failures

- Spare parts inventory: Critical components stocked locally or regionally

- Reporting: Monthly performance reports, availability metrics, fuel consumption

Current O&M Portfolio:

- 260+ MW under management: Across mining, industrial, utility sectors

- 10+ countries: Mali, South Africa, Togo, USA, Middle East, West Africa

- Proven track record: 99%+ availability on Mali gold mine project (36 months)

Data Center Sector-Specific Solutions

Hyperscale Data Centers (100-500 MW Campuses)

Typical Requirements:

- Power demand: 100-500 MW IT load (plus cooling and auxiliaries)

- Reliability: Tier III/IV standards (99.982-99.995% uptime)

- Redundancy: 2N or N+1 electrical infrastructure

- Deployment speed: 12-24 months from land acquisition to operation

- Sustainability: Corporate commitments to renewable energy and carbon neutrality

USP&E Hyperscale Solutions:

Distributed Generation Architecture:

- Multiple gas turbines: 4-8 units of 40-80 MW each (vs. single large grid interconnection)

- Phased deployment: Commission units as demand grows (avoid stranded capacity)

- Redundancy: N+1 configuration with automatic load transfer

- Independent operation: Islanded mode during grid disturbances

Example Configuration (200 MW IT Load):

- Primary power: 4x GE LM6000 turbines (50 MW each = 200 MW total)

- Redundancy: N+1 configuration (3 units carry full load, 4th on spinning reserve)

- Backup fuel: On-site diesel storage for 7-14 days operation (grid gas interruption)

- Combined cycle option: Heat recovery for district cooling (absorption chillers)

Financial Structure:

- Build-Own-Operate (BOO): USP&E owns and operates power plant

- Power Purchase Agreement: 15-25 year PPA at fixed or formula-based pricing

- Data center benefit: No upfront capital, predictable energy costs, off-balance-sheet financing

Project Timeline:

- Site selection to commercial operation: 12-18 months

- vs. Grid interconnection queue: 5-7 years (bypassed entirely)

- Competitive advantage: First-to-market in constrained power markets

Reference Projects:

- Mali gold mine: 25 MW baseload, 99.2% availability over 36 months (similar mission-critical requirements)

- South Africa industrial portfolio: 60+ MW under management, proven O&M excellence

Colocation and Edge Data Centers (5-50 MW)

Typical Requirements:

- Power demand: 5-50 MW IT load

- Multi-tenant: Diverse customer base requiring guaranteed uptime

- Urban locations: Land-constrained sites, strict environmental regulations

- Rapid deployment: Competitive market demands fast time-to-revenue

USP&E Colocation Solutions:

Modular Gas Turbine Architecture:

- GE TM2500 or LM2500: 20-35 MW trailer-mounted units

- Solar Centaur 40: 4-5 MW units for smaller edge facilities

- Siemens SGT-750: 35-40 MW for larger colocation facilities

- Scalability: Add units as tenant demand grows

Example Configuration (30 MW Colocation Facility):

- Primary power: 2x GE TM2500 (25 MW each = 50 MW total capacity)

- N+1 redundancy: Single unit carries full 30 MW load

- Grid interconnection: Net metering or grid export (where regulations permit)

- Backup fuel: 48-72 hour diesel storage

High Power Density Benefit:

- Gas turbine footprint: 1,500 m² (including setbacks and fuel systems)

- vs. Diesel equivalent: 6,000+ m² (4x more land required)

- Urban land value: $5-15M savings in high-cost metros

Revenue Optimization:

- Primary income: Tenant power sales ($0.10-0.20/kWh depending on market)

- Grid services (where available): Frequency regulation, demand response ($10-30/kW-year)

- Renewable energy credits: If natural gas qualifies under state programs

Fast-Track Deployment:

- TM2500 trailer-mounted: 60-90 days from order to commercial operation

- Minimal civil works: Pre-fabricated foundations, quick-connect utilities

- Environmental permitting: Faster approval vs. diesel (lower emissions)

AI Training and GPU Clusters (20-100 MW per Building)

Unique AI Data Center Requirements:

Extreme Power Density:

- Traditional data center: 5-10 kW per rack

- AI training cluster: 50-100+ kW per rack (10x higher)

- Building power density: 100-300 MW per building (vs. 20-50 MW traditional)

- Implication: Grid capacity often unavailable in required timeframe

Continuous Baseload Operation:

- AI model training: Runs 24/7 for weeks or months (cannot be interrupted)

- GPU utilization: Economics demand >90% GPU uptime

- Power quality: Voltage sags or frequency excursions cause expensive training restarts

- Backup requirements: <10 second transfer to backup power (UPS + gas turbine)

USP&E AI Data Center Power Solutions:

Primary Power Configuration:

- GE LM6000 or 6F: 50-180 MW per turbine (single building or multi-building campus)

- Combined cycle: Heat recovery improves efficiency to 55-58%

- Baseload optimization: Turbines run at optimal efficiency point (90-100% load)

- Grid parallel: Export excess capacity during low training demand

Backup and Redundancy:

- UPS systems: 10-30 seconds backup while turbines start

- N+1 gas turbines: Redundant unit on spinning reserve

- Diesel backup: 48-72 hour fuel supply for gas pipeline disruptions

- Black-start capability: Independent operation during grid blackouts

Example Configuration (100 MW AI Training Facility):

- Primary power: 2x GE 6F.03 turbines (80 MW each = 160 MW total)

- Normal operation: Both units at 62.5 MW (78% load, high efficiency)

- N+1 redundancy: Single unit can carry 100 MW at peak rating

- Grid export: 60 MW excess during low training demand (additional revenue)

Economic Case:

- Grid power (where available): $0.08-0.15/kWh + 5-7 year wait

- USP&E gas turbine power: $0.07-0.12/kWh, operational in 6-12 months

- Competitive advantage: Revenue generation 4-6 years earlier = $100-200M NPV

Sustainability Alignment:

- Natural gas: 50% lower CO₂ vs. coal-fired grid power

- Future hydrogen blending: Pathway to carbon-neutral AI training

- Renewable integration: Gas turbines provide firm capacity for intermittent solar/wind

- Carbon offsets: Purchase credits to achieve net-zero commitments while maintaining reliability

Bitcoin and Cryptocurrency Mining (10-100 MW Facilities)

Crypto Mining Power Requirements:

Unique Characteristics:

- 24/7 baseload operation: Mining rigs run continuously for profitability

- Price sensitivity: Electricity is 60-80% of mining operating costs

- Fuel flexibility critical: Ability to switch fuels when economics shift

- Remote locations: Often sited near stranded gas or renewable resources

- Rapid deployment: Short payback periods demand fast project execution

Economic Reality:

- Break-even power cost: $0.04-0.08/kWh (depending on Bitcoin price)

- Grid power: Often $0.08-0.15/kWh (uneconomical for mining)

- USP&E gas turbine solution: $0.05-0.09/kWh (competitive with curtailed renewable energy)

USP&E Cryptocurrency Mining Solutions:

Stranded Gas Monetization:

- Flared gas capture: Deploy turbines at oil wells with associated gas

- Wellhead gas operation: Solar turbines can operate on low-pressure gas (15-60 psig)

- Zero fuel cost: Otherwise-wasted gas becomes revenue-generating asset

- Environmental benefit: Eliminate flaring, reduce methane emissions

Example Configuration (50 MW Bitcoin Mining):

- Primary power: 2x GE LM6000 (50 MW each = 100 MW total)

- Normal operation: Both units at 25 MW (50% load)

- Fuel source: Wellhead gas or pipeline natural gas

- Redundancy: N+1 configuration (single unit can carry full load)

- Expansion capability: Add third turbine as mining capacity grows

Hybrid Renewable-Gas Integration:

- Daytime solar: 30-50 MW solar PV array

- Gas turbine baseload: 20-30 MW continuous (night + cloudy days)

- Battery storage: 5-10 MWh for smoothing and peak shaving

- Mining rig flexibility: Curtail non-critical rigs during peak fuel cost periods

Flexible Commercial Structures:

Build-Own-Operate-Transfer (BOOT):

- USP&E finances and builds: Mining operator avoids upfront capital

- Power Purchase Agreement: Fixed $/kWh over 5-10 years

- Asset transfer: Mining operator takes ownership at contract end

- Benefit: Preserve capital for mining hardware and operations

Equipment Lease:

- No upfront cost: Monthly lease payments

- Maintenance included: USP&E handles all O&M

- Flexible term: 3-7 years typical

- End-of-lease options: Extend, purchase, or return equipment

Revenue Share Structure:

- USP&E provides power plant: No cost to mining operator

- Revenue sharing: Split mining proceeds (e.g., 60/40 or 70/30)

- Risk sharing: Both parties benefit from Bitcoin price appreciation

- USP&E upside: Higher returns vs. fixed PPA in strong crypto markets

Case Study: West Texas Bitcoin Mining

- Challenge: 40 MW mining facility, grid power $0.11/kWh (uneconomical)

- Solution: 2x LM6000 turbines on pipeline natural gas

- Power cost: $0.06/kWh (natural gas at $3.50/MMBtu)

- Result: Mining profitability restored, 18-month payback on turbines

- Timeline: 120 days from contract to mining operations

Current USP&E Inventory for Crypto Mining:

- Multiple LM6000 units: 40-50 MW, dual-fuel, immediate availability

- GE TM2500 trailer units: 25-30 MW, rapid deployment (60-90 days)

- Solar Centaur series: 4-5 MW modular units for distributed mining

Enterprise and Corporate Data Centers (5-20 MW)

Corporate Data Center Requirements:

Business Continuity Focus:

- Mission-critical applications: ERP, CRM, financial systems, customer databases

- Disaster recovery: Geographic redundancy, backup sites

- Compliance requirements: SOC 2, ISO 27001, HIPAA, PCI-DSS (depending on industry)

- Budget constraints: CFO scrutiny on capital expenditures

Hybrid Grid-Gas Turbine Strategy:

- Grid power primary: Lowest cost when available

- Gas turbine backup: <10 second transfer during outages

- Peak shaving: Run turbines during expensive peak demand periods

- Demand charge reduction: Lower monthly utility bills (can save 20-40%)

USP&E Enterprise Solutions:

Packaged Gas Turbine Systems:

- Solar Centaur 40: 4-5 MW turnkey package

- GE TM2500: 25-30 MW trailer-mounted (for larger facilities)

- Siemens SGT-750: 35-40 MW (multi-building campuses)

- Factory integration: Reduced site installation costs and time

Example Configuration (15 MW Corporate Data Center):

- Grid connection: Primary power source

- Gas turbine backup: 1x Solar Centaur 40 (5 MW) or 1x TM2500 (25 MW)

- Automatic transfer: <10 seconds (UPS bridge)

- Dual-fuel capability: Natural gas primary, diesel backup

- Annual testing: Monthly run tests maintain readiness

Economic Benefits:

Peak Shaving (Demand Charge Reduction):

- Utility demand charge: $15-30/kW-month (in many US markets)

- Data center peak demand: 15 MW

- Annual demand charges: $2.7-5.4M

- Peak shaving strategy: Run turbines during monthly peak hours (20-40 hours/year)

- Demand charge reduction: 30-50% savings = $800K-2.7M/year

- Turbine O&M cost: $200-400K/year (for limited operation)

- Net annual savings: $400K-2.3M/year

Backup Power Cost Comparison:

- Diesel generators (15 MW): $3-4M capital cost

- Gas turbine (25 MW TM2500): $8-12M capital cost

- Gas turbine advantages: Peak shaving revenue, cleaner operation, higher reliability

- Payback period: 3-6 years (when including demand charge savings)

Sustainability Benefits:

- ESG reporting: Natural gas backup supports carbon reduction goals

- Future hydrogen-ready: Pathway to zero-emission backup power

- Grid services: Participate in demand response programs (additional revenue)

Regional Focus: Data Center Gas Turbine Solutions Worldwide

United States (Primary Market)

Market Dynamics:

Explosive Data Center Growth:

- Current capacity: ~5,000 MW (Uptime Institute data)

- Projected 2030 capacity: 12,000+ MW

- Growth drivers: AI, cloud computing, 5G edge, crypto mining

- Grid constraint: Utilities cannot keep pace with interconnection requests

Key Markets:

- Northern Virginia (Loudoun County): World's largest data center market (1,500+ MW)

- Texas (Dallas-Fort Worth, Austin, San Antonio): Low power costs, business-friendly

- Arizona (Phoenix): Abundant land, favorable climate for cooling

- Iowa, Nebraska, Oklahoma: Low-cost power, crypto mining hubs

- Oregon, Washington: Renewable energy, tech sector presence

USP&E US Market Solutions:

Grid Queue Bypass Strategy:

- Typical grid interconnection: 5-7 years in PJM, ERCOT, CAISO

- USP&E gas turbine solution: 6-12 months from site selection to operation

- Competitive advantage: Revenue generation begins 4-6 years earlier

- Financial impact: $100-200M NPV for 100 MW facility

Regulatory Navigation:

- Air quality permits: USP&E manages EPA, state environmental agency approvals

- Utility coordination: Grid interconnection (net metering, parallel operation, or islanded)

- Fuel supply: Pipeline gas interconnection or on-site LNG/diesel storage

- Local permitting: Zoning, building permits, fire marshal approvals

Current US Inventory:

- Multiple GE LM6000 units: 40-50 MW, 60 Hz, immediate availability

- GE TM2500 trailer units: 25-30 MW, rapid deployment

- Multiple generator configurations: 13.8 kV standard (480V-13.8 kV available)

US Project Support:

- Offices in USA: Project management, engineering, permitting support

- Local partnerships: EPC contractors, utility coordination specialists

- Financing arrangements: PPA structures, equipment leasing, BOOT options

Contact for US Data Center Projects:

Browse inventory at www.uspeglobal.com/natural-gas-turbines and click "Fast Quote"

Middle East (UAE, Saudi Arabia, Qatar)

Regional Data Center Boom:

Market Drivers:

- Smart city initiatives: Saudi NEOM, UAE Vision 2031

- Digital transformation: Government services, fintech, e-commerce

- Regional hub strategy: Dubai Internet City, Abu Dhabi Global Market

- Hyperscale deployments: AWS, Microsoft Azure, Google Cloud Middle East regions

Unique Requirements:

- Extreme ambient temperatures: 45-50°C summer conditions

- High humidity (coastal): Salt-air corrosion, moisture management

- Fuel availability: Natural gas abundant (Qatar, UAE, Saudi)

- Sustainability mandates: UAE Net Zero 2050, Saudi Green Initiative

USP&E Middle East Solutions:

High-Temperature Optimized Gas Turbines:

- GE LM6000: Proven 50°C+ operation in Gulf region

- Siemens SGT-800: High-temperature package configurations

- Inlet air cooling: Evaporative or chiller-based cooling for performance recovery

- Derating calculations: Site-specific performance guarantees

Example Configuration (Qatar Data Center, 60 MW):

- Primary power: 2x GE LM6000 PD Sprint (60 MW total at ISO)

- Ambient derating: 48 MW output at 50°C (20% derating typical)

- Inlet air cooling: Evaporative cooling recovers 5-8 MW

- Net output: 53-56 MW at extreme ambient conditions

- Fuel source: Qatar North Field pipeline gas

Sustainability Integration:

- Solar-gas hybrid: Daytime solar PV + gas turbine baseload

- Waste heat recovery: District cooling for data center HVAC

- Future hydrogen: GCC countries developing hydrogen economy (turbine-ready)

- Carbon capture: Emerging requirement for large installations

Regional Experience:

- UAE projects: Multiple installations across Dubai and Abu Dhabi

- Saudi Arabia: Active participation in NEOM development

- Qatar: Energy infrastructure for industrial clients

- Iraq, Oman, Kuwait: Regional power generation portfolio

Dubai Office Support:

- Local project management: UAE-based team for Middle East projects

- Logistics expertise: Jebel Ali Port, Khalifa Port coordination

- Regulatory knowledge: DEWA, ADDC, SEC interconnection standards

- Cultural understanding: 20+ years Middle East experience

Africa (South Africa, Kenya, Nigeria, West Africa)

African Data Center Growth:

Market Dynamics:

- Mobile internet explosion: 600+ million smartphone users

- Fintech revolution: M-Pesa, digital banking, mobile money

- Cloud adoption: AWS Cape Town, Microsoft South Africa regions

- Submarine cable investments: 2Africa, Equiano cables (Google)

Unique Challenges:

- Grid unreliability: Frequent outages (South Africa load-shedding, Nigeria grid instability)

- Fuel logistics: Diesel supply chains, natural gas scarcity

- Capital constraints: Limited financing for infrastructure

- Skills availability: Training requirements for local operations

USP&E Africa Solutions:

Islanded Operation (Grid-Independent):

- Primary power: Gas turbines or HFO engines (not backup)

- Grid connection: Opportunistic (export excess or import during low fuel cost periods)

- Black-start capability: No grid dependency for startup

- Fuel diversity: Diesel, HFO, natural gas (where available)

Example Configuration (South Africa, 30 MW Data Center):

- Primary power: 2x Siemens SGT-750 (40 MW each)

- Normal operation: Both units at 15 MW (37.5% load)

- Load-shedding response: Automatic island mode when grid fails

- Fuel: Pipeline natural gas primary, diesel backup (14-day storage)

- Grid export: Sell excess capacity to Eskom (where regulations permit)

Nigeria-Specific Considerations:

- Grid reliability: <50% in many regions (independent generation essential)

- Fuel availability: Diesel widely available, natural gas in Lagos/Port Harcourt

- Currency risk: USD contracts protect against naira volatility

- Security: Compound design, perimeter protection, fuel theft prevention

Regional Expertise:

- South Africa: 60+ employees, 20+ years experience

- Mali: 120+ employees, mining power operations

- West Africa: Togo, Burkina Faso, Liberia, Sierra Leone operations

- East Africa: Kenya, Tanzania, Uganda project experience

Financing for African Projects:

- BOOT structures: USP&E finances, developer pays via PPA

- Development finance: IFC, AfDB, DFC (US Development Finance Corporation) partnerships

- Equipment leasing: Preserve capital for IT infrastructure investment

- Creative structures: Revenue sharing, equity participation

Asia-Pacific (Singapore, India, Australia, Southeast Asia)

APAC Data Center Leadership:

Regional Dynamics:

- Singapore: ASEAN data center hub (strict sustainability requirements)

- India: Explosive growth (Mumbai, Bangalore, Chennai)

- Australia: Hyperscale deployments (Sydney, Melbourne)

- Southeast Asia: Indonesia, Malaysia, Thailand emerging markets

Regulatory Environment:

- Singapore: Moratorium on new data centers (lifted 2022, strict efficiency standards)

- India: Power availability varies by state, open access regulations complex

- Australia: Renewable energy mandates, emissions trading scheme

- Southeast Asia: Diverse regulatory frameworks, fuel availability varies

USP&E APAC Solutions:

Singapore (High-Efficiency Mandate):

- Power Usage Effectiveness (PUE) requirement: <1.3 for new facilities

- Gas turbine solution: Combined cycle achieves 1.2-1.25 PUE with waste heat cooling

- Example: 50 MW GE LM6000 combined cycle + absorption chillers

- Fuel: Singapore LNG terminal, highly reliable supply

- Sustainability: Lowest-carbon solution approved for new builds

India (Grid Constraint + Reliability):

- Challenge: Grid power unreliable in many regions, open access regulations complex

- Solution: Captive power plant (independent generation)

- Configuration: 2-3x Siemens SGT-800 or GE Frame 6 turbines

- Fuel: Pipeline gas (Gujarat, Maharashtra) or LNG (coastal cities)

- Grid connection: Parallel operation during stable periods, island during outages

Australia (Renewable Integration):

- Mandate: Large energy users must procure renewable energy

- Hybrid solution: Solar + wind + gas turbine + battery storage

- Gas turbine role: Firm capacity when renewables underperform

- Example: 100 MW solar + 50 MW wind + 80 MW gas turbine + 50 MWh battery

- Benefit: Achieve renewable energy targets while maintaining 99.99% reliability

Technical Deep Dive: Gas Turbine Technology for Data Centers

Understanding Gas Turbine Performance

Power Output and Derating:

Gas turbine power output varies significantly with ambient conditions:

ISO Base Rating (15°C, sea level, 60% humidity)

- GE LM6000: 43-50 MW (depending on model)

- Siemens SGT-800: 47-57 MW

- GE 6F.03: 70-80 MW

Hot Climate Derating (40°C ambient)

- Power loss: 15-25% vs. ISO rating

- LM6000 at 40°C: 36-40 MW (vs. 43-50 MW at ISO)

- Mitigation: Inlet air cooling (evaporative or chiller-based)

Altitude Derating (3% per 1,000 feet)

- Denver (5,280 feet): 16% power loss

- Mexico City (7,350 feet): 22% power loss

- Solution: Larger turbine or multiple units

USP&E Site-Specific Design:

- Accurate performance guarantees: Vendor data corrected for actual site conditions

- Conservative ratings: Guaranteed minimums, not optimistic estimates

- Seasonal variation analysis: Ensure capacity during worst-case conditions (summer peak cooling loads)

Fuel Flexibility and Economics

Natural Gas (Primary Fuel for Most Data Centers):

Advantages:

- Lowest fuel cost: $3-12/MMBtu (US market, varies by region and season)

- Pipeline delivery: No on-site storage required (reduced land and capital)

- Clean combustion: 50% lower CO₂ vs. coal, minimal NOx/SOx/particulates

- High efficiency: Gas turbines optimized for natural gas operation

Fuel Cost Example (50 MW LM6000, 8,000 hrs/year):

- Natural gas at $5/MMBtu: $0.065/kWh fuel cost

- Annual fuel cost: ~$26 million

- vs. Grid power at $0.10/kWh: $40 million

- Annual savings: $14 million

Pipeline Connection Requirements:

- Pressure: 200-400 psig typical for large turbines

- Volume: 3,000-8,000 scfm for 50 MW turbine

- Pipeline size: 6-12 inch diameter (depending on distance and pressure)

- USP&E coordination: Work with pipeline operators, manage interconnection costs

Diesel / Distillate Fuel (Backup and Dual-Fuel):

Advantages:

- Fuel security: On-site storage provides independence from pipeline/grid

- Dual-fuel operation: Automatic switching when gas unavailable

- Fast deployment: No pipeline construction required (months saved)

- Proven reliability: Decades of turbine operation on diesel

Fuel Cost Reality (higher than gas but critical for reliability):

- Diesel at $3.50/gallon: $0.125/kWh fuel cost (90% higher than natural gas)

- Strategy: Use diesel only for backup/emergency (95%+ of time on gas)

- Storage: 7-30 days typical (balance cost vs. security)

Storage Requirements (50 MW turbine, 14-day backup):

- Fuel consumption: ~3,000 gallons/hour at full load

- 14-day storage: ~1 million gallons (3,785 m³)

- Tank configuration: Multiple tanks for redundancy and fire safety

- Costs: $2-4 million (tanks, containment, piping, pumps)

USP&E Dual-Fuel Design:

- Seamless fuel switching: <30 seconds transition (no power interruption)

- Automatic operation: Switch to diesel when gas pressure drops

- Manual override: Operator can select fuel for economic dispatch

- Testing protocol: Monthly diesel operation maintains system readiness

Future Fuels (Hydrogen and Ammonia):

Hydrogen Blending (decarbonization pathway):

- Current capability: Most modern gas turbines can accept 5-15% hydrogen blend (no modifications)

- Medium-term (2025-2030): 30-50% hydrogen blend (combustion system upgrades)

- Long-term (2030+): 100% hydrogen combustion (major modifications or new turbines)

Ammonia (Alternative Zero-Carbon Fuel):

- Status: Emerging fuel for power generation

- Advantage: Easier storage and transport vs. hydrogen

- Challenge: Turbine technology still developing (2030+ commercial availability)

USP&E Future-Fuel Strategy:

- Hydrogen-ready turbines: GE and Siemens models with hydrogen roadmaps

- Design consideration: Plan for future fuel supply infrastructure

- Economics: Monitor green hydrogen cost trajectories (currently $5-12/kg vs. $3-5/MMBtu gas equivalent)

Emissions and Environmental Permitting

Gas Turbine Emissions (Natural Gas Operation):

Modern Low-Emission Combustion:

- NOx (Nitrogen Oxides): <15-25 ppm @ 15% O₂ (Dry Low Emissions combustion)

- CO (Carbon Monoxide): <10-50 ppm

- VOCs (Volatile Organic Compounds): <10 ppm

- Particulates (PM10/PM2.5): Negligible (<5 lb/MMBtu)

- SOx (Sulfur Oxides): Near-zero (natural gas contains minimal sulfur)

CO₂ Emissions (cannot be eliminated without carbon capture):

- Natural gas: ~117 lb CO₂/MMBtu (EIA data)

- 50 MW turbine, 8,000 hrs/year: ~100,000 tonnes CO₂/year

- vs. Coal-fired power: ~50% lower CO₂ per kWh

- vs. Diesel generators: ~30% lower CO₂ per kWh

Environmental Permitting (US EPA Process):

Air Quality Permits:

- Prevention of Significant Deterioration (PSD): Required for large sources (>250 tons/year any pollutant)

- Title V Operating Permit: Required for major sources

- State Implementation Plan (SIP): State-specific requirements (varies CA, TX, NY, etc.)

- BACT Analysis: Best Available Control Technology determination

USP&E Permitting Support:

- Air dispersion modeling: Predict downwind pollutant concentrations

- BACT determination: Justify low-emission combustion technology

- Agency coordination: EPA, state environmental agencies, local air districts

- Timeline: 6-18 months (varies by jurisdiction and project size)

- Success rate: 100% permit approval on all USP&E projects (25-year track record)

Noise Regulations:

Gas Turbine Noise Levels:

- Unenclosed turbine: 100-110 dBA at 1 meter

- With acoustic enclosure: 75-85 dBA at 10 meters

- Property line requirement: Typically 55-65 dBA (depending on zoning)

USP&E Acoustic Design:

- Acoustic enclosures: Absorption lining, mass-loaded barriers

- Inlet/exhaust silencers: Reactive and absorptive silencing

- Equipment layout: Distance attenuation, barriers, berms

- Predictive modeling: Guarantee compliance before construction

Financial Structures and Investment Models

1. Traditional EPC (Equipment Purchase + Installation)

Structure:

- Client purchases equipment: Outright ownership from day one

- USP&E provides turnkey delivery: Engineering, equipment, construction, commissioning

- Payment milestones: Mobilization, equipment delivery, substantial completion, final acceptance

Typical Payment Terms:

- 10% mobilization: Upon contract signing (covers engineering, mobilization costs)

- 40% equipment delivery: When turbine ships (covers majority of equipment costs)

- 40% substantial completion: When plant achieves performance tests

- 10% final acceptance: After 30-90 day reliability run, punch-list completion

Financing Options:

- Corporate cash: Balance sheet purchase (for investment-grade companies)

- Equipment financing: Secured loan from commercial banks or leasing companies

- Project finance: Non-recourse debt (for IPP structures with PPA)

- Tax equity: Leverage ITC/PTC (if renewable/hybrid components qualify)

Advantages:

- Asset ownership: Client owns valuable power generation asset

- Depreciation benefits: Tax shields for profitable entities

- Exit flexibility: Can sell, relocate, or repurpose equipment

- Lower long-term cost: No ongoing lease/PPA premiums

Best For:

- Investment-grade corporations with strong balance sheets

- Utilities and regulated entities

- Projects with clear long-term economics

- Owners seeking asset appreciation/residual value

2. Build-Own-Operate (BOO) with Power Purchase Agreement

Structure:

- USP&E finances project: Equity + debt capital for full project cost

- USP&E owns and operates: Retains asset ownership throughout contract

- Client signs PPA: Pays fixed or formula-based $/kWh for delivered energy

- Contract term: Typically 15-25 years

PPA Pricing Structures:

Fixed Price PPA ($0.07-0.12/kWh typical range):

- Predictable costs: Client budgets long-term electricity expense

- USP&E assumes risk: Fuel cost, equipment performance, maintenance

- Market conditions: Pricing depends on fuel forecasts, utilization assumptions

Formula-Based PPA (Fuel Pass-Through):

- Structure: Fixed capacity charge ($/kW-month) + variable energy charge (fuel cost + fixed O&M)

- Example: $15/kW-month capacity + ($4/MMBtu gas × heat rate + $0.015/kWh O&M)

- Risk sharing: Client pays actual fuel costs, USP&E guarantees efficiency

- Benefit: Lower overall cost vs. fixed PPA (client assumes fuel price risk)

Financial Benefits to Client:

- Zero upfront capital: Preserve cash for core business (IT equipment, facility construction)

- Off-balance-sheet: Operating expense (OPEX) vs. capital expense (CAPEX)

- Guaranteed performance: USP&E contractually obligated to deliver power (availability guarantees)

- Predictable costs: Long-term budget certainty

USP&E Returns:

- Project equity IRR: 12-18% typical (depending on risk profile)

- Revenue sources: PPA payments over 15-25 years

- Residual value: Asset ownership at contract end (can extend PPA, sell, or redeploy)

Best For:

- Hyperscale data centers prioritizing speed and capital efficiency

- REITs and data center developers (off-balance-sheet preferred)

- Projects with long-term certainty (20+ year lease, owned land)

- International projects where local ownership beneficial

3. Build-Own-Operate-Transfer (BOOT)

Structure:

- Similar to BOO: USP&E finances, builds, and operates

- Asset transfer: Client takes ownership at contract end

- Transfer pricing: Residual value, nominal amount, or pre-agreed price

Why BOOT vs. BOO:

- Government/utility projects: Regulatory requirement for eventual public ownership

- Tax considerations: Client wants depreciation benefits after initial period

- Strategic asset: Long-term power generation integral to business (not outsourced forever)

Transfer Mechanisms:

- Residual value: Client pays fair market value at year 15-20

- Nominal transfer: $1 or minimal amount (economics built into PPA pricing)

- Pre-agreed price: Fixed amount known at contract outset ($X million at year 20)

Best For:

- Government and municipal data center projects

- University and institutional facilities

- Utility-scale developments with regulatory constraints

- Projects where long-term ownership strategic

4. Operating Lease (OPEX Model)

Structure:

- USP&E owns equipment: Retains title throughout lease

- Client leases equipment: Monthly payments over 3-15 year term

- Full-service lease: Maintenance, parts, labor included (optional)

- End-of-lease options: Extend, purchase (FMV or fixed price), or return

Lease Payment Structure:

- Base lease payment: Equipment cost amortization + interest

- Service component (if full-service): Maintenance, parts, monitoring, support

- Example: $150-250K/month for 30 MW gas turbine (10-year term, full-service)

Advantages:

- 100% OPEX: No capital budget required

- Short-term flexibility: 3-7 year terms vs. 20-year PPA

- Technology refresh: Upgrade equipment at lease end

- Tax benefits: Lease payments fully deductible

Best For:

- Enterprises with OPEX budgets (no CAPEX approval required)

- Short-term projects (crypto mining, temporary demand)

- Test/pilot programs (prove economics before long-term commit)

- Uncertain long-term demand (flexibility to return equipment)

5. Revenue Share / Joint Venture

Structure (Unique to High-Value Applications like Crypto Mining):

- USP&E provides power plant: No cost to client (partner)

- Client provides: Land, operations, market expertise (e.g., mining hardware, operations)

- Revenue sharing: Split proceeds (e.g., 60/40, 70/30)

- Risk/reward sharing: Both parties benefit from strong markets

Example: Bitcoin Mining Joint Venture

- USP&E invests: $40M (2x LM6000 turbines + balance of plant)

- Mining partner provides: $20M mining hardware (ASICs), land, operations

- Revenue split: 60% mining partner / 40% USP&E (negotiable)

- Bitcoin mined: ~700 BTC/year (50 MW, current difficulty)

- Revenue at $40K/BTC: $28M/year gross

- USP&E share: $11.2M/year (28% cash-on-cash return)

- Mining partner: $16.8M/year (84% return on hardware investment)

Advantages:

- Aligned incentives: Both parties benefit from operational excellence

- Risk sharing: Downside protection vs. fixed-price contracts

- Upside participation: USP&E benefits from strong commodity prices (Bitcoin, etc.)

Best For:

- Speculative/commodity-driven applications (crypto, stranded gas monetization)

- Partners with complementary expertise (power + mining/processing)

- Emerging markets with unclear economics (shared discovery)

Why USP&E is the World's Premier Data Center Gas Turbine Partner

1. Largest Global Inventory = Fastest Deployment

The Speed Advantage:

- Owned equipment: 100+ MW in USP&E inventory (immediate availability)

- Exclusive representation: 500+ MW of premium units (30-90 day access)

- Direct relationships: 3,000+ MW globally (sourcing capability)

vs. Competitors:

- OEMs (GE, Siemens): 18-24 month manufacturing lead times for new builds

- Brokers/dealers: Don't own equipment, depend on owner willingness to sell

- Other EPCs: Limited inventory, rely on OEM delivery schedules

Real-World Impact:

- Grid interconnection queue: 5-7 years

- USP&E gas turbine solution: 6-12 months site-to-operation

- Competitive advantage: 4-6 years earlier revenue generation

- Financial value: $100-200M NPV for 100 MW data center

2. Complete EPC Capability = Single-Source Accountability

350+ In-House Engineers:

- Electrical engineers: Power systems, grid interconnection, protection

- Mechanical engineers: Gas turbines, HVAC, piping, fuel systems

- Civil/structural engineers: Foundations, buildings, site development

- Controls engineers: SCADA, automation, cybersecurity

Why Single-Source Matters:

- No finger-pointing: One contract, one throat to choke

- Faster execution: No coordination delays between multiple contractors

- Cost certainty: Lump-sum pricing, no change orders from scope gaps

- Quality assurance: ISO 9001:2015 certified processes throughout

vs. Multi-Contractor Approach:

Case Study: Multi-Contractor Failure

- Project: 80 MW data center, California

- Original approach: Client contracted turbine (OEM), civil (local), electrical (separate), commissioning (third party)

- Result: 18-month delay, $12M in change orders, lawsuits between contractors

- USP&E alternative: Would have delivered turnkey in 6 months, single fixed price

3. Proven Operations Excellence = Guaranteed Uptime

260+ MW Currently Under Management:

- Geographic diversity: Mali, South Africa, Togo, UAE, USA

- Application diversity: Mining, industrial, utility, data center

- Track record: 99%+ availability on mission-critical installations

Mali Gold Mine Case Study (Relevant to Data Center Reliability):

- Client: Major international gold producer

- Application: 25 MW baseload power (processing plant cannot stop)

- USP&E solution: Diesel-HFO hybrid with solar integration

- Contract: Full O&M with 95% availability guarantee

- Actual performance: 99.2% availability over 36 months

- Unplanned downtime: <70 hours/year (0.8%)

- Result: Contract extended through mine life, client referrals

Data Center Relevance:

- Similar criticality: Processing plant downtime = production loss; data center downtime = SLA penalties, reputation damage

- Proven O&M systems: Preventive maintenance, spare parts logistics, 24/7 staffing

- Performance guarantees: Backed by actual operational data, not marketing promises

Availability Guarantee Structure:

- Contractual commitment: 95-98% availability (depending on configuration)

- Performance measurement: Monthly reporting, third-party verification available

- Financial penalties: Liquidated damages for underperformance (typically 5-10% of monthly payment)

- Performance bonuses: Incentives for exceeding targets (shared value creation)

O&M Service Differentiators:

- 24/7 operations centers: Remote monitoring, predictive diagnostics

- Local staffing: Boots on ground, <4 hour response times

- OEM partnerships: Direct relationships with GE, Siemens, Solar Turbines

- Spare parts inventory: Critical components stocked regionally (minimize downtime)

- Training programs: Operator certification, continuous improvement

4. Financial Strength = Project Certainty

Capital Investment Capability:

- Equipment deposits: USP&E places multi-million dollar deposits to secure turbines

- Project financing: Arrange debt + equity for BOO/BOOT structures

- Balance sheet strength: 25-year track record, zero bankruptcies or restructurings

Why This Matters:

- Equipment availability: When client ready, turbine already secured (not on 24-month backorder)

- Price protection: Equipment reserved at contracted price (no price escalation risk)

- Schedule certainty: Delivery guaranteed (contractual commitments backed by deposits)

Competitor Comparison:

- Brokers: No capital, depend on seller willingness (deals fall apart frequently)

- Small EPCs: Insufficient capital to reserve equipment (client assumes availability risk)

- OEMs direct: Require large deposits from clients upfront (capital burden on buyer)

USP&E Approach:

- We invest first: Place deposits and secure equipment before client commits

- Client protected: Equipment availability guaranteed in contract

- Shared risk: Our capital at risk if project doesn't proceed (demonstrates commitment)

5. Global Reach + Local Expertise = Worldwide Deployment

Office Network:

- USA: Project management, engineering, business development

- South Africa: 60+ engineers, regional headquarters

- UAE: Dubai office for Middle East projects

- Mali: 120+ employees for West Africa operations

150+ Projects Across 35 Countries:

- North America: USA, Mexico

- Middle East: UAE, Saudi Arabia, Qatar, Iraq, Oman, Kuwait

- Africa: South Africa, Mali, Burkina Faso, Togo, Liberia, Sierra Leone, Nigeria, Kenya, Tanzania, DRC, Namibia, Zimbabwe

- Asia: Myanmar, Indonesia

- South America: Guyana, Colombia

Cultural and Regulatory Expertise:

- Permitting navigation: Experience with EPA, state agencies, international environmental standards

- Utility interconnection: PJM, ERCOT, CAISO, DEWA, CEB, Eskom, and dozens more

- Local content requirements: Employment, training, procurement from local suppliers

- International finance: World Bank, IFC, AfDB, DFC, ECAs (export credit agencies)

Logistics Mastery:

- Port operations: Jebel Ali, Port Louis, Cotonou, Lagos, Port Elizabeth

- Heavy transport: Oversized loads, route surveys, permitting

- Customs clearance: HS codes, duty optimization, temporary import permits

- Remote sites: Helicopter access, security protocols, supply chain resilience

6. Compliance and Ethics = Zero Legal Risk

Perfect 25-Year Legal Record:

- Zero litigation: Never sued by client, partner, or vendor

- Zero bankruptcies: Financially stable throughout economic cycles

- 100% contract performance: All commitments honored, payments made on time

FCPA and OFAC Compliance:

- US-based company: Subject to Foreign Corrupt Practices Act

- Rigorous due diligence: All parties vetted (clients, partners, subcontractors)

- No sanctioned regions: Will not work in Russia, Iran, or blacklisted areas

- Transparent processes: No bribes, kickbacks, or corrupt practices

ISO Certification:

- ISO 9001:2015: Quality management systems

- ISO 45001:2018: Occupational health and safety

- Regular audits: Third-party verification, continuous improvement

Why This Matters for Data Centers:

- Publicly traded companies: Cannot risk association with unethical suppliers

- Institutional investors: ESG requirements demand ethical supply chains

- Regulatory scrutiny: SEC, DOJ enforcement of FCPA increasingly aggressive

- Reputation protection: One scandal can destroy years of brand building

USP&E Commitment:

- Ethical operations: Non-negotiable, embedded in company culture

- Risk mitigation: Protect clients from legal and reputational exposure

- Long-term partnerships: Integrity builds trust, trust enables collaboration

Project Execution: How USP&E Delivers Data Center Gas Turbine Solutions

Phase 1: Initial Consultation and Qualification (Week 1-2)

Step 1: Confidential Engagement

- Mutual NDA: Protect project information for all parties

- Initial discussion: Teams/Zoom call to understand requirements

- Site information: GPS coordinates, ambient conditions, existing infrastructure

Information Gathering:

- Power requirements: MW capacity, load profile, redundancy requirements

- Reliability standards: Tier II/III/IV classification, uptime commitments

- Timeline: Construction schedule, power-on date, critical path milestones

- Budget: Total project budget, CAPEX vs. OPEX preference

- Fuel availability: Natural gas pipeline, diesel supply, future LNG

- Environmental: Permitting status, emissions constraints, noise limits

- Grid connection: Utility coordination, interconnection plans, net metering

Preliminary Assessment:

- Technology recommendation: Gas turbine model(s) suited to application

- Configuration options: Single large turbine vs. multiple smaller units

- Commercial structure: EPC, BOO, BOOT, lease comparison

- High-level budget: ±30% ROM (rough order of magnitude) estimate

- Schedule estimate: Engineering, procurement, construction, commissioning

Deliverable: Preliminary proposal with technology options and budget ranges

Phase 2: Feasibility Study and Detailed Proposal (Week 3-8)

Conceptual Feasibility Study ($150,000-$250,000 investment):

Scope of Work:

- Site assessment: Geotechnical overview, access evaluation, utilities assessment

- Power system design: Single-line diagram, equipment sizing, redundancy architecture

- Technology comparison: Gas turbine options (GE, Siemens, Solar), performance analysis

- Fuel supply analysis: Pipeline connection requirements, diesel storage sizing

- Environmental assessment: Emissions estimates, noise predictions, permitting pathway

- Grid interconnection: Utility coordination requirements, protection schemes

- Economic modeling: CAPEX estimate (±25%), OPEX forecast, LCOE analysis

- Risk assessment: Technical, schedule, regulatory, financial risks identified

Deliverables:

- Feasibility report (50-100 pages): Executive summary, technical analysis, financial model

- Technology recommendation: Specific turbine models with rationale

- Preliminary drawings: Site layout, single-line diagram, P&ID overview

- Cost estimate: Equipment, installation, soft costs (±25% accuracy)

- Project schedule: Critical path, major milestones, delivery date forecast

- Risk register: Identified risks with mitigation strategies

Timeline: 30-60 days from authorization

Decision Point: Proceed to detailed engineering and contracting, or pause/modify approach

Phase 3: Detailed Engineering and Contracting (Month 2-4)

Detailed Engineering Design ($380,000-$1,250,000 investment):

Scope of Work:

- Site surveys: Topographic survey, geotechnical investigation, environmental baseline

- Power system detailed design: Load flow analysis, short circuit study, protection coordination

- Gas turbine specifications: Performance guarantees, site-specific derating, acceptance criteria

- Balance of plant engineering:

- Mechanical: Fuel systems, cooling systems, exhaust, auxiliary equipment

- Electrical: Switchgear, transformers, cabling, grounding, lightning protection

- Civil/structural: Foundations, buildings, paving, drainage

- Controls: SCADA design, cybersecurity, utility interconnection protocols

- Environmental permitting: Air quality permit applications, noise studies, stormwater plans

- Construction planning: Methodology, schedule, resource loading, logistics

- Procurement packages: Equipment specifications, bid documents, vendor prequalification

Deliverables:

- Construction-ready drawings (100-300 sheets): Civil, mechanical, electrical, instrumentation

- Technical specifications (500-1000 pages): Equipment specs, materials standards, quality requirements

- Cost estimate (±10% accuracy): Bill of quantities, unit pricing, contingency analysis

- Construction schedule: CPM schedule with logic ties, float analysis, critical path

- Permits and approvals: Applications submitted, agency coordination ongoing

- Procurement recommendations: Vendor selection, commercial terms, delivery schedules

Timeline: 60-120 days from authorization

Contract Negotiation (Parallel with Engineering):

- Commercial terms: Fixed-price vs. cost-plus, payment terms, performance guarantees

- Technical specifications: Equipment performance, testing procedures, acceptance criteria

- Schedule commitments: Milestone dates, liquidated damages, early completion bonuses

- Warranty terms: Equipment warranties, workmanship guarantees, extended coverage options

- Insurance and bonding: Builder's risk, liability coverage, performance bonds

- Change order procedures: Scope change management, pricing mechanisms

Contract Signature: EPC agreement executed, notice to proceed issued

Phase 4: Procurement and Manufacturing (Month 3-7)

Equipment Procurement:

Gas Turbine Package (Lead Item):

- USP&E owned inventory: Equipment already available (zero lead time)

- Exclusive representation: 30-90 days to secure and release

- OEM direct (if required): 18-24 months manufacturing (avoided with USP&E inventory)

Balance of Plant Equipment (Long-Lead Items):

- Transformers: 12-20 weeks (USP&E stocks common sizes to expedite)

- Switchgear: 8-16 weeks

- Generators/alternators: 10-16 weeks (if not included with turbine package)

- Cooling systems: 8-12 weeks (radiators, chillers)

- Fuel systems: 6-10 weeks (gas trains, diesel tanks, pumps)

- Control systems: 8-12 weeks (SCADA, PLCs, HMIs)

USP&E Procurement Advantages:

- Vendor relationships: 25+ years with major manufacturers (priority treatment)

- Volume leverage: Multi-project purchasing power (better pricing)

- Inventory stocking: Critical items pre-purchased (eliminates lead times)

- Quality assurance: Factory inspections, witness testing, expediting

Shipping and Logistics:

- International sourcing: Europe (Siemens, ABB), USA (GE, Caterpillar), Asia (transformers, switchgear)

- Consolidation: Container stuffing, load optimization

- Ocean freight: 4-8 weeks (Europe/Asia to USA)

- Port operations: Customs clearance, heavy-lift coordination

- Inland transport: Heavy-haul, oversized load permitting

Milestone: Equipment delivered to site, ready for installation

Phase 5: Construction and Installation (Month 5-9)

Site Preparation (Weeks 1-4):

- Mobilization: Contractor setup, temporary facilities, utilities

- Clearing and grading: Site preparation, access roads, laydown areas

- Drainage: Stormwater management, detention ponds

- Underground utilities: Electrical duct banks, water, sewer, communications

Civil Works (Weeks 3-8):

- Foundations: Turbine pad (mass concrete, typically 2-4 meters deep)

- Equipment slabs: Generator, transformers, switchgear, auxiliary equipment

- Buildings: Control room, maintenance shop, warehouse

- Fire protection: Water storage tanks, piping, hydrants

- Site improvements: Paving, fencing, landscaping, security

Mechanical Installation (Weeks 6-14):

- Gas turbine setting: Rigging, alignment, grouting

- Generator connection: Coupling alignment, electrical terminations

- Fuel systems: Gas piping, diesel storage tanks, pumps, filters

- Cooling systems: Radiator installation, piping, fans

- Exhaust systems: Stack installation, silencers, emissions monitoring

- Auxiliary systems: Lubrication, starting systems, fire protection

Electrical Installation (Weeks 8-16):

- Switchgear installation: Medium voltage (13.8 kV typical), protection relays

- Transformer installation: Step-up transformers (to utility voltage or data center distribution)

- Cable pulling: Power cables, control cables, instrumentation

- Grounding systems: Equipment grounding, lightning protection

- Utility interconnection: Protection schemes, metering, communication

- SCADA integration: Control systems, HMI, remote monitoring

Quality Control Throughout:

- Daily inspections: USP&E site engineers, QA/QC specialists

- Materials testing: Concrete, soil compaction, weld inspections (Class 4 welders for fuel systems)

- Vendor inspections: Equipment witness testing, factory acceptance tests

- Documentation: As-built drawings, test reports, O&M manuals

Milestone: Substantial completion (equipment installed, ready for commissioning)

Phase 6: Commissioning and Startup (Month 9-10)

Pre-Commissioning (Weeks 1-2):

- System checks: Equipment inspections, alignment verification, cleanliness

- Electrical testing: Insulation resistance (megger testing), continuity, phasing

- Control system testing: I/O checks, logic verification, HMI functionality

- Mechanical systems: Lubrication systems, fuel systems, cooling systems

- Safety systems: Fire protection, gas detection, emergency shutdown

Cold Commissioning (Weeks 2-3):

- First fuel: Fuel system pressurization, leak testing

- First motoring: Turbine rotation without firing (check alignments, vibrations)

- Auxiliary systems: Verify all support systems operational

- Instrumentation calibration: Sensors, transmitters, protection relays

Hot Commissioning (Weeks 3-4):

- First fire: Initial turbine ignition, low-load operation

- Load testing: Gradual load increase to full rated power

- Performance testing: Verify output, efficiency, emissions at multiple load points

- Grid synchronization (if applicable): Parallel operation with utility, protection verification

- Islanded operation: Black-start testing, load acceptance, frequency regulation

Performance Testing (Week 4-5):

- Acceptance test: Demonstrate guaranteed performance (power, efficiency, emissions)

- Reliability run: 72-168 hours continuous operation (prove availability)

- Emergency scenarios: Loss of grid, fuel switching, automatic load shedding

- Documentation: Test reports, as-built drawings, O&M manuals

Operator Training (Week 4-6, parallel with testing):

- Classroom training: Theory of operation, systems overview, safety procedures

- Hands-on training: Normal operations, startups, shutdowns, routine maintenance

- Emergency procedures: Fire response, gas leaks, equipment failures, grid disturbances

- Certification: Operator qualification, ongoing training programs

Milestone: Final acceptance, handover to operations

Typical Timeline Summary:

- Fast-track (diesel/gas generators): 90-150 days

- Gas turbine power plants: 120-180 days

- Large/complex installations: 180-240 days

Phase 7: Long-Term Operations and Maintenance (Years 1-20+)

Operations Support:

- 24/7 monitoring: Remote operations center, real-time diagnostics

- Performance tracking: Efficiency, availability, fuel consumption

- Optimization: Combustion tuning, load dispatch optimization

- Reporting: Monthly performance reports, environmental compliance reporting

Maintenance Programs:

- Preventive maintenance: OEM-recommended schedules (daily, weekly, monthly, quarterly, annual)

- Predictive maintenance: Vibration analysis, oil analysis, thermography, borescope inspections

- Corrective maintenance: Emergency repairs, equipment failures

- Major overhauls: Hot section inspections (25,000 hrs), major overhauls (50,000 hrs)

Parts and Materials:

- OEM genuine parts: Direct from GE, Siemens, Solar Turbines

- Critical spares inventory: Stocked locally or regionally (minimize downtime)

- Supply chain management: Forecasting, procurement, logistics

- Warranty management: OEM warranty administration, claims processing

Continuous Improvement:

- Performance analysis: Identify efficiency improvements, cost reduction opportunities

- Technology upgrades: Control system updates, combustion optimization

- Training: Ongoing operator development, new technology adoption

- Best practices: Share learnings across USP&E global portfolio

Contract Performance:

- Availability guarantees: 95-98% contractual commitments

- Performance incentives: Bonuses for exceeding targets

- Client satisfaction: Regular business reviews, relationship management

Getting Started: Your Path to Reliable Data Center Power

Immediate Action Steps

For Data Center Developers and Operators:

Step 1: Browse Current Equipment Inventory Visit USP&E's online inventory and review available gas turbines:

- Natural Gas Turbines: www.uspeglobal.com/natural-gas-turbines

- Diesel Generators (backup/hybrid): www.uspeglobal.com/diesel-generators

- Natural Gas Generators: www.uspeglobal.com/natural-gas-generators

Action: Click "Fast Quote" on any units of interest for immediate response

Step 2: Schedule Preliminary Consultation

- Teams/Zoom call: 30-60 minute discussion of project requirements

- Information exchange: Share site details, power needs, timeline

- Preliminary recommendations: Technology options, commercial structures, budget guidance

Step 3: Sign Mutual NDA

- Confidentiality protection: Safeguard project information for all parties

- Commission structure (if brokers/consultants involved): Clear terms for intermediary compensation