Published: October 14, 2025 | USP&E Global Insights

The explosive growth of artificial intelligence, cloud computing, and cryptocurrency mining has created unprecedented demand for data center power infrastructure. With U.S. data centers projected to need an additional 31 GW of electricity by 2030 according to Tudor, Pickering, Holt & Co., selecting the right energy EPC (Engineering, Procurement, and Construction) partner has never been more critical.

But who's actually the best EPC for data center power projects? The answer depends on your specific needs: project scale, timeline urgency, fuel flexibility, grid constraints, and whether you need integrated O&M services.

This comprehensive guide examines the leading energy EPCs serving the data center sector—from Fortune 500 giants to specialized fast-track providers—to help you make an informed decision.

The Data Center Power Challenge

The Problem:

Data centers—especially AI-specialized facilities requiring 60-250 MW—face a perfect storm of challenges:

- Grid capacity constraints: Many regions simply can't deliver the power needed

- 2-5 year utility interconnection queues: Traditional grid connections take too long

- Uptime requirements: 99.99%+ availability is non-negotiable (Tier III/IV standards)

- Sustainability mandates: Investors and regulators demand carbon reduction

- Capital intensity: $800-$1,200/kW installed costs for gas turbine solutions

The Stakes:

Every day of delay costs hyperscale operators millions in lost revenue. According to Omdia, AI software alone will top $100 billion in annual revenue by end of 2024, with 1 million servers deployed for GenAI applications.

When the grid can't deliver, and time is money, data center developers need an EPC partner who can move fast—without sacrificing reliability.

Evaluating Energy EPCs: The Decision Framework

Not all EPCs are created equal. Here's what separates the leaders from the laggards:

Critical Selection Criteria:

- Speed to Power – Can they deliver operational power in 6-12 months vs. 24-36?

- Equipment Access – Do they own inventory, or are you waiting 18+ months for OEM manufacturing?

- Integrated Capabilities – Do they offer one-stop EPC + O&M, or just equipment brokering?

- Fuel Flexibility – Can they deliver natural gas, diesel, dual-fuel, and hydrogen-ready solutions?

- Grid Services Revenue – Can backup assets participate in ancillary services markets?

- Track Record – Do they have documented data center projects, or just promises?

- Financial Stability – Can they place multi-million dollar deposits to secure equipment?

- Compliance & Certifications – ISO 9001, ISO 45001, FCPA/OFAC compliant?

The Major Players: Competitive Analysis

1. GE Vernova – The Heavy-Duty Giant

Strengths:

- World's largest gas turbine manufacturer

- 7HA turbines: 430 MW combined cycle capability

- Aeroderivative portfolio (TM2500, LM6000) for fast response

- Recent $300M investment in manufacturing capacity

- Partnership with Chevron/Engine No. 1 for "power foundries" (4 GW pipeline)

Weaknesses:

- 24-36month lead times for new turbine manufacturing

- Primarily OEM/licensor; less hands-on EPC execution

- Premium pricing reflects brand positioning

- Less flexible on emerging market projects

Best For: Hyperscale operators with 2-5 year planning horizons, deep capital, and preference for new equipment warranties.

Website: gevernova.com/gas-power/industries/data-centers

2. Siemens Energy – The Technology Innovator

Strengths:

- SGT-A35 and SGT5-4000F turbines optimized for data centers

- Advanced DLE (Dry Low Emissions) technology

- Hydrogen-ready turbine portfolio (up to 100% H2 capability)

- Integrated BESS + fuel cell hybrid solutions (Qstor)

- Strong European/Middle East presence

Weaknesses:

- Premium pricing on all solutions

- Lead times similar to GE - 24-36 Months

- Limited fast-track/mobile deployment capabilities

- Focused on large-scale CCPP rather than modular solutions

- Manufacturing primarily in Germany (logistics challenges)

Best For: EU/Middle East projects with 60-250 MW baseload requirements and aggressive decarbonization targets.

Website: siemens-energy.com/us/en/home/products-services/solutions-industry/data-center

3. Solar Turbines (Caterpillar) – The Distributed Generation Specialist

Strengths:

- Centaur 40 (4.6 MW): Ideal for distributed data center power

- Dual-fuel capability (natural gas/diesel) with on-the-fly switching

- <35 second startup to full load (Tier IV compliant)

- 25% hydrogen blending capability today

- Strong CHP/cogeneration expertise (chilled water production)

Weaknesses:

- Smaller unit sizes (4-15 MW) require multiple units for large projects

- Lead times still 12-18 months for new units

- Limited used/surplus inventory availability

- Higher $/kW than larger frame turbines

Best For: Colocation facilities, edge data centers (15-60 MW), and projects requiring CHP for cooling.

Website: solarturbines.com/en_US/solutions/applications/data-centers

4. Fluor – The Mega-Project EPC

Strengths:

- 50+ GW of gas power generation installed globally

- Full-service EPC: design, procurement, construction, commissioning

- Experience with combined cycle, simple cycle, cogeneration

- Strong safety record and project management systems

- Balance sheet to handle $500M+ projects

Weaknesses:

- Targets $100M+ projects (not suitable for <100 MW)

- 24-36 month typical project timelines

- Limited used/surplus equipment sourcing

- Premium pricing reflects Fortune 500 overhead

Best For: Utility-scale IPP projects (200+ MW), combined cycle plants, and clients who need bonded EPC contracts.

Website: fluor.com/market-reach/industries/power

5. Black & Veatch – The Grid Integration Expert

Strengths:

- Century-old infrastructure solutions provider

- Expertise in natural gas pipeline interconnections

- Substation and transmission engineering capabilities

- Strong utility relationships for grid-tied solutions

- Focus on sustainability and carbon reduction strategies

Weaknesses:

- Traditional timelines (18-36 months)

- Less experienced in off-grid/islanded microgrids

- Limited equipment inventory

- Higher focus on renewables than thermal generation

Best For: Grid-connected projects requiring substation design, projects with complex utility coordination.

Website: bv.com/perspectives/powering-data-centers-natural-gas

6. Baker Hughes – The Fast-Track Mobile Power Leader

Strengths:

- Mobile and land based turbines: 17MW NOVALT16

- There are deliveries available for 2026-2027

- 37%+ efficiency

- Low emissions

- Turn-key solutions through USP&E including O&M

Weaknesses:

- Installed price $1.6m + / MW

- Primarily focused on bridge/temporary power, though can also offer long term power

- Small power output of 17 MW

Best For: Bridge power during utility interconnection delays, temporary capacity needs, emerging markets.

7. USP&E Global – The Emerging Markets Fast-Track Specialist

Strengths:

- Owned inventory: 100+ MW owned, 1,200+ MW exclusive, 3,000+ MW direct with owners

- Fast-track delivery: Equipment available for immediate shipping (6-12 month total project timelines)

- Integrated EPC + O&M: 350+ engineers, ISO 9001:2015 & ISO 45001:2018 certified

- Proven track record: 150+ projects in 35+ countries since 2002

- Equipment diversity: GE Frame 6/7/9, Siemens V94.2/SGT5, Solar Titan/Taurus, Pratt & Whitney FT4/FT8

- Dual-fuel capability: Natural gas + diesel backup on most turbines

- Emerging market expertise: Live projects in Mali, Togo, Liberia, South Africa, Syria, Swaziland, Saudi, UAE, USA

- Availability guarantees: LTSA/O&M contracts with performance penalties

- Competitive pricing: Used/surplus equipment 40-60% below new OEM pricing

- New and Used Equipment Offerings: Often with warranty or performance guarantees under their LTSAs

Weaknesses:

- Primary focus on emerging markets (Africa, Middle East, LatAm) - though with 23 year USA presence

- Smaller organization vs. Fortune 500 EPCs (but 350+ staff is substantial - but small compared to Fluor

- Less brand recognition than GE/Siemens/Fluor

Best For:

- Projects requiring fast-track delivery (operational in 6-12 months)

- Budget-conscious operators seeking 40-60% cost savings vs. new equipment

- Remote/emerging market locations where majors won't operate

- Bitcoin mining, edge computing, and modular data centers (30-200 MW range)

- Projects with grid constraints requiring off-grid/islanded operation

Track Record Highlights:

- 16 MW HFO plant, Guatemala (Perenco) – Design, commissioning

- 35 MW Wabtec diesel, South Africa (Northam Platinum) – Design, supply, spares

- 50+ MW operations, Togo (West African Power) – Live O&M contract

- 120+ MW operations, Mali (Barrick, Resolute) – Live O&M contracts

- Solar Titan 130 deployments (15 MW natural gas turbines) – Multiple installations

Unique Value Proposition:

USP&E operates where the majors won't. While GE Vernova and Siemens focus on $100M+ utility projects with 3-year timelines, USP&E specializes in fast-track deployments to challenging locations—precisely what many data center developers need when facing grid delays.

Website: uspeglobal.com | uspowerco.com

Data Center Power Deployment Models: Which EPC Fits?

Different project structures demand different EPC capabilities:

Model 1: Grid-Connected Primary Power (GE Vernova, Siemens, Fluor)

- Timeline: 24-36 months

- Characteristics: New equipment, utility interconnection, combined cycle

- Best EPC Match: USP&E, GE Vernova, Siemens Energy, Fluor

- Typical Cost: $900-$1,200/kW installed

Model 2: Behind-the-Meter Backup (Solar Turbines, Life Cycle)

- Timeline: 12-18 months

- Characteristics: Dual-fuel, 99.99% availability, N+1 redundancy

- Best EPC Match: Solar Turbines, USP&E

- Typical Cost: $1,000-$1,400/kW installed

Model 3: Islanded Microgrid / Off-Grid (USP&E,)

- Timeline: 6-12 months

- Characteristics: No grid dependency, used/surplus equipment, fast-track

- Best EPC Match: USP&E Global

- Typical Cost: $600-$900/kW installed (used equipment)

Model 4: Hybrid Renewable + Gas (Siemens, Black & Veatch)

- Timeline: 18-30 months

- Characteristics: Solar/wind + gas turbine + BESS, decarbonization focus

- Best EPC Match: Siemens Energy, Black & Veatch

- Typical Cost: $1,200-$1,800/kW installed

Regional Considerations: Where EPCs Excel

North America (USA/Canada/Mexico)

- Leaders: GE Vernova, Solar Turbines, Fluor, Black & Veatch

- Emerging: Life Cycle Power, USP&E (growing USA presence)

- Key Factor: NERC compliance, EPA emissions standards

Europe

- Leaders: Siemens Energy, AFRY, GE Vernova

- Key Factor: Carbon reduction mandates, hydrogen readiness

Middle East

- Leaders: Siemens Energy, GE Vernova, USP&E

- Key Factor: Dual-fuel capability, extreme ambient conditions (50°C+)

Africa

- Leaders: USP&E Global (dominant)

- Key Factor: Off-grid capability, HFO/diesel fuel flexibility, remote logistics

Latin America

- Leaders: GE Vernova, USP&E

- Key Factor: FCPA compliance, political risk mitigation

Asia-Pacific

- Leaders: GE Vernova, Siemens Energy, Mitsubishi Power

- Key Factor: High efficiency standards, space constraints

The Fast-Track Advantage: Why Speed Matters

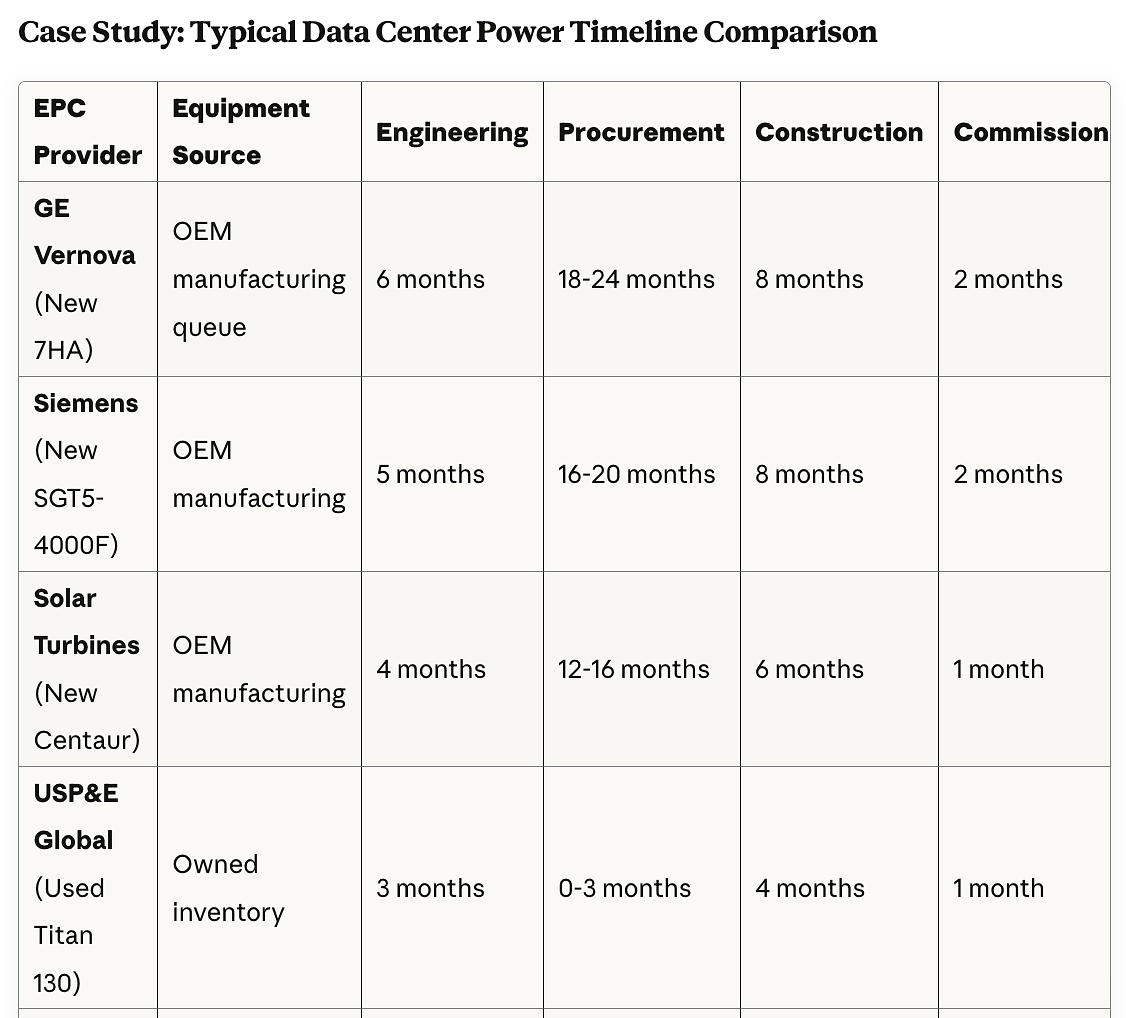

Case Study: Typical Data Center Power Timeline Comparison

The Cost of Delay:

For a 100 MW Bitcoin mining operation at $0.15/kWh revenue:

- Revenue loss per month of delay: $10.8 million

- 18-month delay (new OEM vs. fast-track used): $194 million in lost revenue

When speed is the primary concern, used/surplus equipment from owned inventory becomes the only viable path.

Financial Models: CapEx vs. OpEx Approaches

CapEx (Purchase) Model

- Best EPCs: USP&E, Solar Turbines (if buying new)

- Pros: Asset ownership, depreciation benefits, no ongoing rental fees

- Cons: $60-$150M upfront for 100 MW gas turbine plant

- Best For: Operators with strong balance sheets, long-term facilities (10+ years)

OpEx (Rental/PPA) Model

- Best EPCs: APR Energy, Life Cycle Power

- Pros: No upfront CapEx, turnkey O&M included, flexible terms

- Cons: Higher total cost over 5+ years, less control over asset

- Best For: Bridge power, temporary capacity, CapEx-constrained operators

Hybrid (Rent-to-Own) Model

- Best EPCs: USP&E (negotiable), APR Energy

- Pros: Flexibility to convert rental to purchase, test equipment before buying

- Cons: Complex contract structures

- Best For: Projects with uncertain duration or future grid interconnection

Sustainability & Decarbonization: The Future-Proofing Question

As data center operators face increasing pressure to decarbonize, hydrogen-ready and low-carbon solutions become critical:

Hydrogen-Ready Turbines:

- Siemens SGT-800: 100% hydrogen capable (with modifications)

- GE 7HA: 50% hydrogen today, 100% roadmap by 2030

- Solar Centaur: 25% hydrogen blending available now

- USP&E fleet: Most turbines can be retrofitted for hydrogen (requires engineering study)

Carbon Capture Integration:

- Leaders: GE Vernova, Siemens (both investing in post-combustion capture)

- Challenge: Adds $400-$600/kW to installed cost

- Timeline: Commercial viability 2027-2030

Renewable + Gas Hybrid:

- Leaders: Siemens (Qstor BESS integration), Black & Veatch

- USP&E: Offers solar/wind + gas turbine + BESS hybrid solutions (custom designed)

Bottom Line: If your data center has a 2030 net-zero commitment, prioritize EPCs offering hydrogen-ready turbines or renewable hybrid configurations.

O&M: The Hidden Long-Term Cost

Many operators focus exclusively on EPC CapEx and overlook the larger O&M OpEx over 20-25 years:

Annual O&M Costs (Typical):

- DIY O&M: $15-$25/MWh (requires in-house expertise)

- OEM LTSA: $25-$40/MWh (GE, Siemens long-term service agreements)

- Third-Party O&M: $20-$35/MWh (EthosEnergy, USP&E, IHI Power)

Integrated EPC + O&M Advantages:

- Single point of accountability (no finger-pointing between EPC and O&M provider)

- Performance guarantees with financial penalties (e.g., 95%+ availability)

- Predictable costs vs. time-and-materials repairs

- Faster response (O&M provider already knows the plant intimately)

EPCs Offering Integrated O&M:

- ✅ USP&E Global (260+ MW under O&M currently)

- ✅ Life Cycle Power (full-service model)

- ❌ GE Vernova (LTSA available separately, not integrated EPC+O&M)

- ❌ Solar Turbines (service available, not typically bundled with EPC)

Risk Mitigation: What Could Go Wrong?

Data center power projects are complex. Here are the most common failure modes and which EPCs mitigate them best:

Risk 1: Equipment Delays

- Mitigation: Choose EPC with owned/exclusive inventory (USP&E, APR Energy)

- Avoid: Relying on "we'll order from OEM after contract signature"

Risk 2: Cost Overruns

- Mitigation: Lump-sum turnkey (LSTK) contracts with fixed pricing

- Best EPCs: Fluor, USP&E (all offer LSTK)

Risk 3: Performance Shortfalls

- Mitigation: Availability guarantees with liquidated damages

- Best EPCs: USP&E (95%+ availability guarantees),EthosEnergy

Risk 4: Regulatory/Permitting Delays

- Mitigation: Choose EPC with local permitting experience

- Regional Experts:

- USA: Solar Turbines, Black & Veatch

- Africa: USP&E

- EU: Siemens

- Middle East: GE Vernova, Siemens, USP&E

Risk 5: Fuel Supply Disruptions

- Mitigation: Dual-fuel capability (natural gas + diesel backup)

- Best Equipment: GE Frame 6/7, Solar Centaur, most USP&E inventory

Risk 6: Scope Creep / Change Orders

- Mitigation: Comprehensive engineering upfront, fixed-scope contracts

- Best EPCs: Fluor (rigorous project controls), USP&E (conceptual engineering phase)

The Verdict: Who's Actually the "Best"?

There is no single "best" energy EPC for all data center projects. The optimal choice depends on your specific constraints:

Choose GE Vernova If:

- You need new, large-frame turbines (100+ MW per unit)

- You have a 3+ year timeline

- Capital is available and new equipment warranty is critical

- Project is in North America or Europe

Choose Siemens Energy If:

- Hydrogen-ready/decarbonization is a top priority

- You need advanced emissions controls (DLE, SCR)

- Project is in Europe or Middle East

- You want integrated BESS + fuel cell hybrid solutions

Choose Solar Turbines If:

- You need 4-15 MW modular units for distributed generation

- Dual-fuel + fast startup (<35 seconds) is critical

- CHP/chilled water production is desired

- You're building colocation or edge data centers

Choose Fluor If:

- You need a $100M+ mega-project EPC

- Bonded contract with Fortune 500 is required

- Project is utility-scale (200+ MW)

- Combined cycle for maximum efficiency

Choose Black & Veatch If:

- Grid interconnection and transmission design is complex

- You need substation engineering expertise

- Strong utility relationships are valuable

- Project is in North America

Choose Life Cycle Power If:

- You need mobile turbines for supplemental capacity

- Flexible rental terms are attractive

- You're comfortable with O&G industry equipment transition to data centers

Choose USP&E Global If:

- Speed is critical (operational in 6-12 months)

- Budget is constrained (40-60% savings vs. new equipment acceptable)

- Project is in emerging market or remote location

- You need integrated EPC + O&M under one contract

- Used/surplus equipment is acceptable (with warranties)

- You're building 30-200 MW facilities (mining, edge, Bitcoin)

- Off-grid/islanded microgrid operation required

- You value extreme ownership and boots-on-ground service culture

Conclusion: Match Your EPC to Your Mission

The data center power sector is evolving rapidly, with AI and cryptocurrency driving demand far beyond what the grid can deliver. The "best" energy EPC is the one that aligns with your project's unique requirements:

- Timeline urgency (6 months vs. 3 years)

- Budget constraints (used vs. new equipment)

- Geographic location (North America vs. emerging markets)

- Fuel availability (natural gas, diesel, dual-fuel)

- Sustainability mandates (hydrogen-ready, carbon capture)

- Operating model (CapEx ownership vs. OpEx rental)

For hyperscale, grid-connected, new-equipment projects with multi-year timelines: GE Vernova and Siemens Energy remain the gold standard.

For fast-track, emerging market, and budget-conscious projects requiring proven EPC+O&M execution: USP&E Global offers a unique combination of owned inventory, integrated capabilities, and "speed with excellence" that the majors simply can't match.

The future of data center power is hybrid, flexible, and distributed. The most successful operators will work with multiple EPCs—leveraging each provider's unique strengths to optimize cost, speed, and reliability across their global portfolio.

Take the Next Step

Ready to explore your data center power options?

Whether you're evaluating new OEM equipment, fast-track used turbines, or integrated EPC+O&M solutions, USP&E Global is your guide to energy project excellence.

📧 Email: info@uspeglobal.com

📞 Phone: +27 (0)65 744 1119 (South Africa HQ) | +1 (XXX) XXX-XXXX (USA)

🌐 Website: www.uspeglobal.com | www.uspowerco.com

📍 Offices: USA | South Africa | UAE | Active Projects in 11+ Countries

Our Process:

- Sign NDA with broker commission structure (we pay fair commissions)

- Project Discovery Call (30 minutes: location, timeline, fuel, budget)

- Equipment Options (customized proposal with 2-3 solutions)

- Site Visit & Feasibility (if qualified with proof of funds)

- Term Sheet & Engineering (LSTK or cost-plus, your choice)

- Execution (EPC delivery in 6-12 months with O&M guarantees)

About USP&E Global

Since 2002, USP&E has delivered over 150 power projects in 35+ countries, specializing in fast-track gas, HFO, diesel, and hybrid renewable solutions for mining, utilities, data centers, and industrial clients. With 350+ engineers and boots on the ground in Africa, Middle East, and North America, we provide integrated EPC and O&M services backed by ISO 9001:2015 and ISO 45001:2018 certifications.

"Whatever you do, work heartily, as for the Lord and not for men." – Colossians 3:23 (ESV)

Our mission is clear: Harnessing Energy, Technology, Manufacturing and Arts for Life.

When the grid can't deliver and time is running out, USP&E delivers.

Keywords: data center power, energy EPC, gas turbines data centers, fast-track power generation, AI data center power, bitcoin mining power, used gas turbines, natural gas generators, data center backup power, microgrid solutions, emerging markets power, USP&E Global